Saved in the financial crisis

Federal government gradually withdraws from Commerzbank

This audio version was artificially generated. More info | Send feedback

The federal government provided more than 18 billion euros to help the struggling Commerzbank during the 2008/2009 financial crisis. Since then, the company has stabilized and is already paying back billions. Now the federal government wants to gradually sell its shares and redeem billions again.

The state is planning to exit Commerzbank. As a first step, the federal government wants to reduce its stake in the institute, as the Finance Agency of the Federal Republic of Germany announced. “The federal government's entry into Commerzbank in 2008 and 2009 was important in order to protect financial market stability in the midst of the banking crisis,” explained Florian Toncar, Parliamentary State Secretary in the Federal Ministry of Finance and Chairman of the relevant inter-ministerial steering committee. Now Commerzbank is once again a stable and profitable institute. “It is therefore necessary for the federal government to gradually divest itself of the shares in the successfully stabilized institute.”

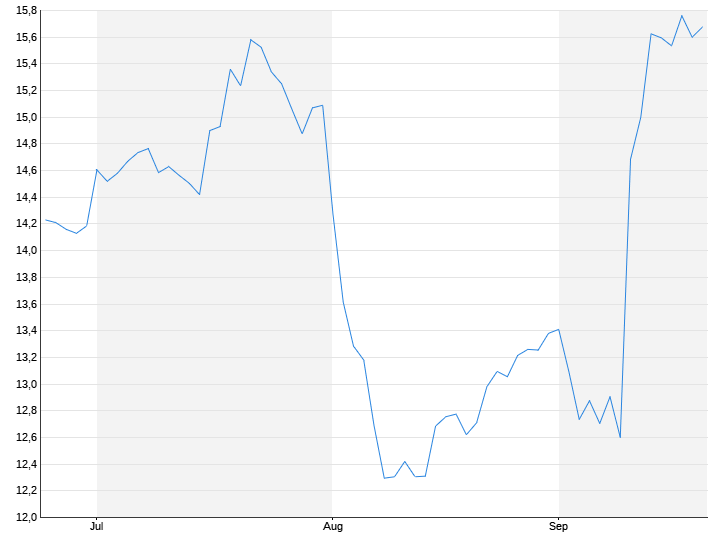

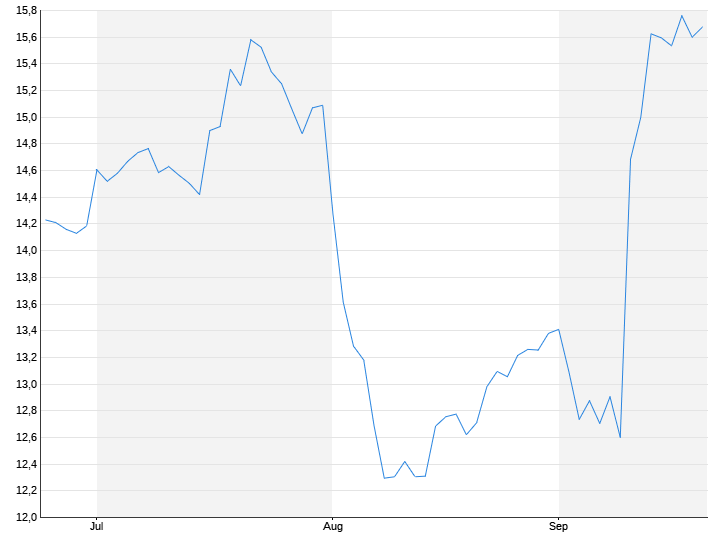

The bank's economic situation has steadily improved since 2021, said Eva Grunwald, managing director of the finance agency. The federal government is therefore reacting logically by reducing its stake in Commerzbank and beginning the exit. The sale of the share package in question is to be carried out transparently and in a way that protects the market, the statement said. The interministerial steering committee will decide on further sales steps in due course.

The federal government had recently not participated in several of Commerzbank's share buyback programs, which meant that its stake in the bank had increased slightly again. Commerzbank closed last year with its largest profit in 15 years. The consolidated profit of Germany's second-largest bank rose by 55 percent to 2.2 billion euros compared to 2022. Sales rose by more than ten percent to 10.5 billion euros.

CEO Manfred Knof, who has been at the helm of Germany's second-largest listed bank since 2021, has ordered a profound transformation of the bank. Jobs have been cut and the branch network has been scaled back. As a result, the bank is now operating much more profitably. In January, the federal government announced that it would increasingly divest from company holdings and, over the course of the year, it had already cashed in part of its stake in Deutsche Post and Deutsche Telekom.

Commerzbank got into financial difficulties in the wake of the 2008 financial market crisis and received capital assistance totaling 18.2 billion euros from the Financial Market Stabilization Fund (FMS) in 2008 and 2009 to maintain financial market stability. According to the information, around 13.15 billion euros have been repaid so far. The federal government currently holds a 16.49 percent stake in Commerzbank through the FMS. The institute is currently valued at around 15.8 billion euros on the stock exchange.