Extraordinary uncertainties

Mercedes does not expect any growth – dividend increases

This audio version was artificially generated. More info | Send feedback

The car manufacturer Mercedes is not very optimistic about the current year and is even expecting a slightly lower result. The business risks are too great given the numerous conflicts around the globe. However, the shareholders should not suffer from this. The distributions are increasing and billions are flowing into price maintenance.

Delivery problems for important models and a difficult environment have resulted in less money in the till for the car manufacturer Mercedes. The operating result (EBIT) fell by four percent over the year to 19.7 billion euros. Revenue increased slightly to 153.2 billion euros, as the DAX group announced. The bottom line was 14.5 billion euros – two percent less than in 2022. The dividend for the past financial year is expected to increase by ten cents to 5.30 euros per share. In addition, the share buyback program will be increased by up to three billion euros.

The company is currently cautious for the current year: sales should be at the previous year's level with stable car sales. The operating result is likely to fall slightly. Mercedes-Benz sees returns in the car business at 10 and 12 percent, which is also lower. “The economic situation and the automobile markets are still characterized by exceptional uncertainty,” it said. Possible interruptions in supply chains and bottlenecks in the availability of parts are further significant risk factors.

The return in the main car division fell by two points to 12.6 percent last year, while profits in the van division rose by almost two thirds. The margin rose to 15.5 percent. In total, the group delivered almost 2.5 million vehicles to customers worldwide. The passenger car division accounted for around two million units of this. A good one in eight vehicles (twelve percent) had a plug.

Production problems at the supplier Bosch with 48-volt systems for combustion engines slowed down the important GLC and E-Class models at Mercedes. This is said to have affected around 100,000 vehicles, which will be postponed until this year.

The Stuttgart team still did better than expected. According to data from LSEG, experts had expected an average EBIT of 18.8 billion euros and a consolidated result of 13.7 billion euros.

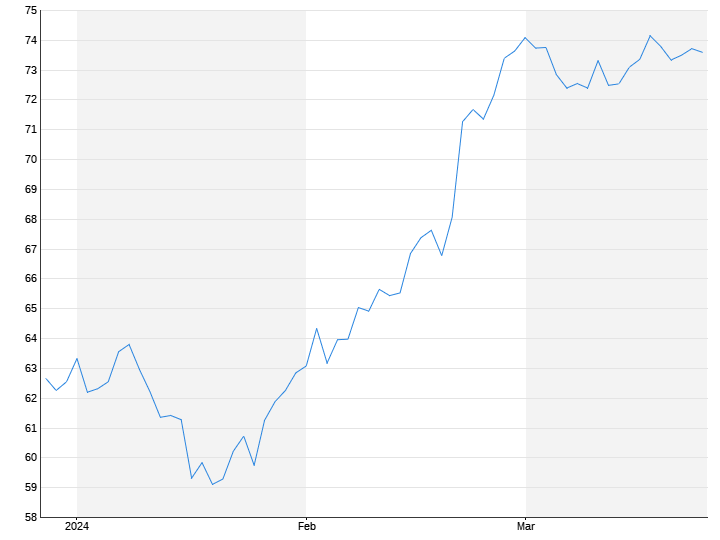

Market participants' initial reactions are that the share price will rise slightly. Although the figures are marked by a significant decline in profits, they are still mostly slightly above expectations. The outlook, in turn, corresponds to what was to be expected, it is said. It is positive that the group is increasing its share buyback program. The papers should be confiscated. This would – at least theoretically – increase the profit per share.