Special dividend planned

Airbus wants to increase deliveries

This audio version was artificially generated. More info | Send feedback

The aircraft manufacturer Airbus is still not giving its suppliers any rest. They are monitoring their situation, but will always ask for more, they say. Despite the tense situation, there will be no compromises in quality. The DAX group is aiming for a higher operating result for the current year.

The European aircraft manufacturer Airbus wants to increase production and profits further this year despite ongoing problems with suppliers. Around 800 commercial aircraft are to be delivered, said CEO Guillaume Faury in Toulouse. That would be 65 more aircraft than last year. The number is the right balance between the high demand and the hurdles in ramping up production, said the Frenchman. “There is no single bottleneck, the supply chain is a world full of bottlenecks.” Things will improve with supplies, but further expansion will make things more difficult again.

Engine manufacturers and other suppliers have repeatedly warned that they cannot simply keep up with the increase. However, the Airbus boss is sticking to the goal of increasing production of the best-seller, the A320 short-haul aircraft family, from around 50 to 75 aircraft per month by 2026. “We are closely monitoring the supplier situation, but we are always asking for more.” But the quantity will never come at the expense of quality, said Faury, referring to US rival Boeing, which has been struggling with quality problems for years.

Last year, the French-German group increased its sales by eleven percent to 65.4 billion euros. Adjusted earnings before interest and taxes (EBIT) rose by four percent to 5.8 billion euros, but missed the target of six billion euros. This was due to the space division, where profits collapsed due to depreciation and special charges of 600 million euros, particularly in the satellite business. Faury spoke of a “significant achievement given the complexity of the business” in view of the figures.

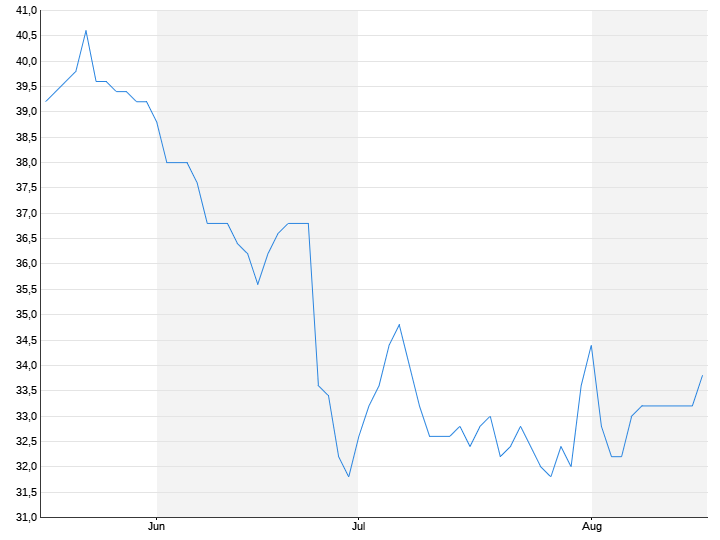

For the current year, Airbus forecast an adjusted EBIT of 6.5 billion to 7.0 billion euros. The forecast is conservative, wrote analysts from Bernstein Research, among others. The share price lost almost one percent on the Paris stock exchange. “If we are at the pre-coronavirus level in terms of deliveries, profits will also be in this order of magnitude again,” said CFO Thomas Toepfer. In 2019, Airbus delivered 863 aircraft to airlines and leasing companies, generating an adjusted EBIT of 6.9 billion euros.

Airbus' net profit fell by eleven percent to 3.8 billion euros in 2023. Adjusted operating cash flow (free cash flow), however, was 4.4 billion euros, well above the targeted three billion euros. This means that Airbus now has a net 10.7 billion euros in reserve. The surpluses are also to benefit shareholders: In addition to the stable dividend of 1.80 euros, a special dividend of 1.00 euros per share is planned. This is quicker and easier than a share buyback, explained Toepfer.

As usual, the lion's share of profits comes from the production of commercial aircraft. The helicopter division increased profits by 15 percent. Airbus is once again showing weaknesses in the Defence & Space division. There, operating profits fell by 40 percent to 229 million euros. In a letter to employees in January, Faury described the negative surprises in the satellite business as “unacceptable” and announced a change in management in the space division. Nevertheless, he wants to hold on to the “OneSat” satellites. In principle, it is a great program.