US indices continue to rise

Merger with Trump company boosts Digital World

This audio version was artificially generated. More info | Send feedback

Wall Street is still on an upward trend, with the Dow up 0.9 percent. Among individual stocks, investors are particularly interested in Digital World shares. The US Securities and Exchange Commission (SEC) had cleared the way for a merger with a company owned by Donald Trump

New economic data gives traders on Wall Street reason to believe that the long-awaited interest rate cut is getting closer. Dow Jones Index of the standard values closed 0.9 percent higher at 38,773 points on Thursday. The technology-heavy Nasdaq advanced 0.3 percent to 15,906 points. The broad-based S&P500 rose 0.6 percent to 5029 points.

US companies scaled back their production in January. US retailers also had a surprisingly poor start to the year. This fuelled new hopes for long-term falling interest rates from the US Federal Reserve, which is trying to fight inflation with a tight monetary policy without strangling the economy. Analysts were also optimistic. “The economy is doing well, inflation has fallen significantly and we don't want to focus on the small disappointments in these numbers,” said Todd Morgan, chairman of investment advisor Bel Air in Los Angeles.

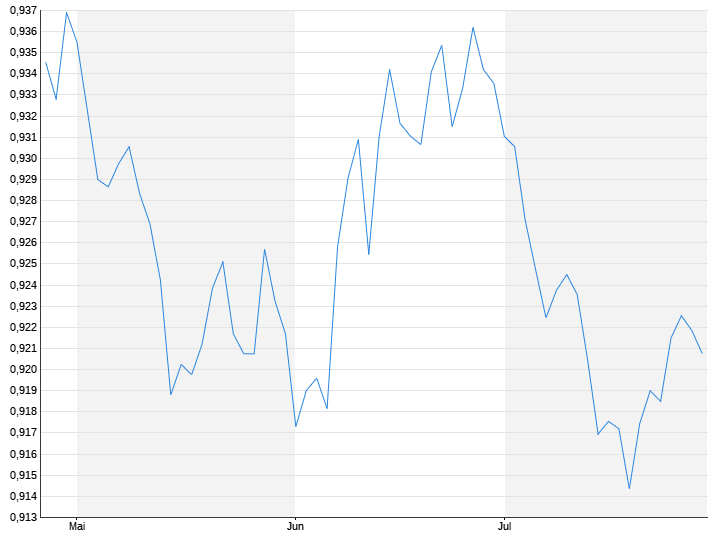

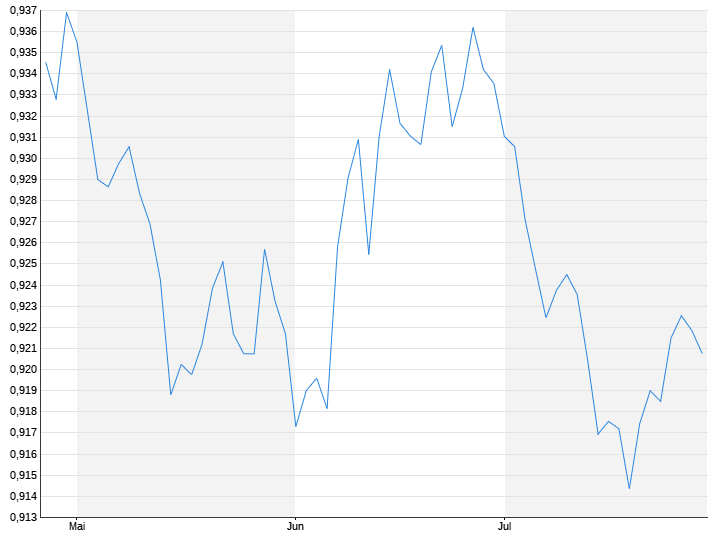

The fact that the Fed will probably not initiate the interest rate turnaround until June due to the slow subsidence of US inflation pressure has not thrown the global stock markets off course, according to Christian Henke of broker IG: “Investors seem to think that postponed is not cancelled.” The expectation of long-term falling interest rates depressed the Dollar Index by 0.4 percent to 104,278 points. The Euro gained the same amount to $1.0769.

Oil price increases

The strong dollar and hopes for an economic recovery following the expected interest rate cuts are supporting oil prices. The North Sea crude oil Brent rose by two percent to 82.93 dollars per barrel (159 liters). The price for the light US variety WTI climbed by around two percent to $78.05 per barrel. A weak greenback makes dollar-traded commodities cheaper for investors from other currency areas. “The prospect of interest rate cuts is back on the table, and that is causing some movement in the market again,” summarized Phil Flynn, analyst at broker Price Futures Group.

In the corporate world, the US Securities and Exchange Commission cleared the way for a merger of Digital World with a company owned by Donald Trump, thereby driving the Digital World share The shares shot up by more than 16 percent. The Securities and Exchange Commission (SEC) has declared the registration of a planned merger with Trump's Media & Technology Group (TMTG) to be effective, Digital World announced. The former US President wants to use the SPAC company as a takeover vehicle for the IPO of “Trump Social” Digital World announced that it would announce the date of an extraordinary shareholders' meeting within two working days to vote on the merger. Digital World shares have risen by more than 150 percent since January 15, when Trump won the Republican primary in Iowa for their presidential candidacy.

The shares of Deere & Co lost more than five percent. The agricultural and construction machinery manufacturer expects a subdued demand for expensive agricultural machinery in view of high loan interest rates and falling crop prices. SoundHound with a price jump of 67 percent to 3.76 dollars. The chip giant Nvidia had announced a stake in the small specialist in the field of artificial intelligence (AI).