Long weekend for investors

Inflation data slows Wall Street again

This audio version was artificially generated. More info | Send feedback

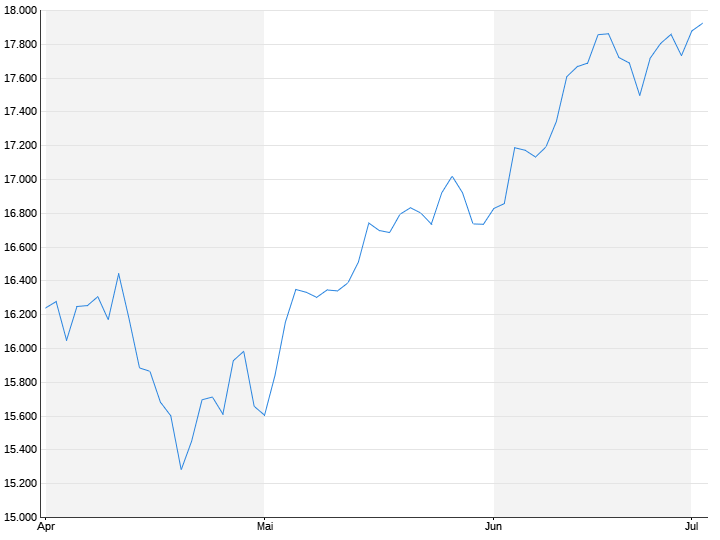

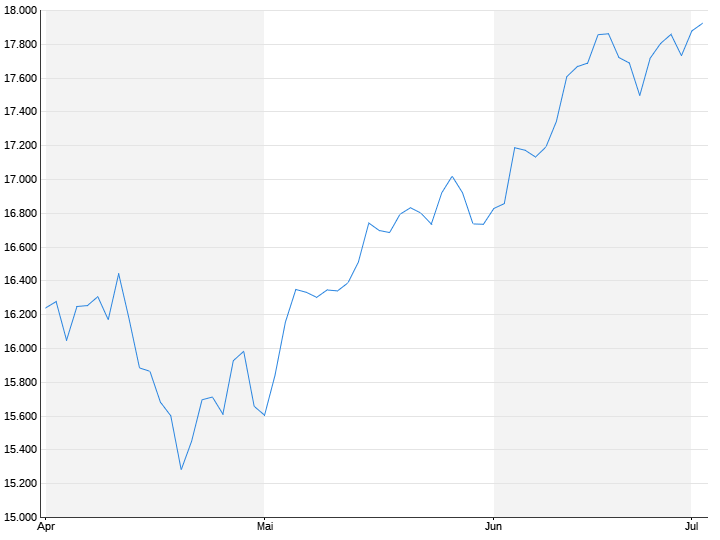

If the economy is booming and producer prices are rising, this runs counter to hopes that key interest rates will fall again. And it dampens investors' buying mood on Wall Street. So by the end of the week, a potential record high is once again receding into the distance.

Disappointment over unexpectedly high US producer prices dampened buying mood on Wall Street on Friday. Initially, it looked like prices would continue to rise and potentially reach new record highs, before inflation data put a stop to that. At 0.3 percent month-on-month, producer prices rose noticeably more than the 0.1 percent expected, and the core rate even rose by 0.5 percent.

This caused headwinds for stocks from the interest rate side, as was recently seen with the negative surprise in consumer prices. The fact that a long weekend is approaching may also have contributed to the reticence. On Monday, business in the USA will be closed due to the Washington's Birthday holiday.

At the Bond market Yields shot up. In the ten-year range, they temporarily reached their highest level since the end of November 2023. Building permits provided a small counterweight to the interest rate outlook. They fell much more sharply than expected in January. And the University of Michigan's consumer sentiment index also slightly missed the consensus estimate of economists of 80.0 in February, with a value of 79.6.

The US economy is doing well

The Dow Jones Index closed 0.4 percent lower at 38,628 points. The S&P 500 lost 0.5 percent. The technology-heavy Nasdaq Composite lost 0.8 percent. The 942 (Thursday: 2359) price gainers on the NYSE were offset by 1877 (497) losers, while 77 (51) stocks closed unchanged.

The latest uptrend on the US stock market was driven by economic confidence, given the continued robustness of US economic data. The flip side of the coin is that robust economic data runs counter to hopes of a rapid fall in interest rates in the US. Producer prices have now followed the same trend. On the interest rate futures market, the probability of a first interest rate cut in June promptly fell from 80 percent the day before to just under 70.

According to observers, the fact that the losses on Friday were mostly limited was because the data did not change the fact that inflation is on the decline overall. A postponement of interest rate cuts alone is not perceived as a catastrophe. Doubts about a “bullish” event – in this case interest rate cuts – must be distinguished from fear of “bearish” events such as a renewed rise in inflation or an economic collapse, explained Tim Hayes, Chief Global Investment Strategist at Ned Davis Research. Appropriately, the dollar interim gains. The dollar index was little changed recently.

Semiconductor supplier gives positive outlook

On the corporate side, Applied Materials the technology segment a positive impulse. The supplier to the semiconductor industry performed better than expected in its first business quarter and also gave a positive outlook. The share price rose by 6.3 percent.

Nike lost 2.4 percent. The sporting goods manufacturer announced that it would reduce its workforce by around 2 percent or 1,600 employees. Doordash fell by 8.1 percent. The food delivery service exceeded expectations in its fourth quarter, but traders said that, given the previously very good performance of the stock, some market participants were probably expecting even better figures.

Draftkings has significantly reduced its loss in the reporting quarter, but analysts had actually expected a profit. The sports betting provider's share price recovered from initial losses and rose by 0.2 percent. Roku fell by around 24 percent. The streaming service provider missed expectations in light of a weaker advertising environment. Trade Desk rose 17.5 percent, driven by an unexpectedly strong outlook. The crypto exchange Coinbase (+8.8%) had closed a quarter with a profit for the first time in almost two years.