Waiting for Nividia

Wall Street is coping well with the Fed's hesitation

This audio version was artificially generated. More info | Send feedback

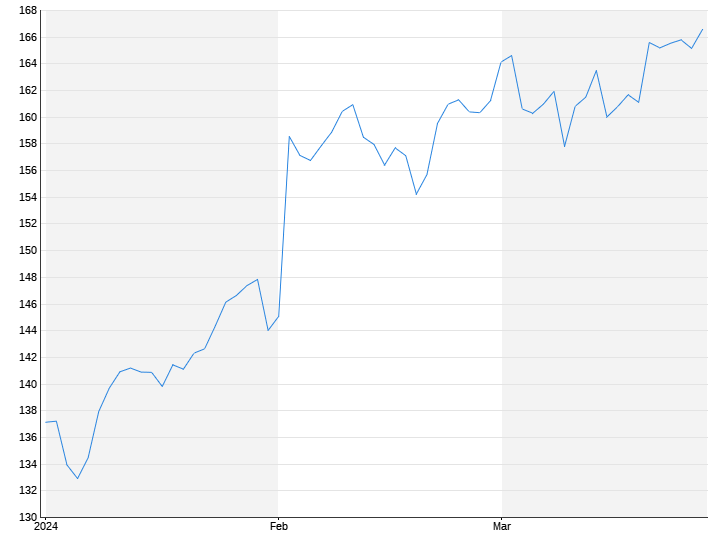

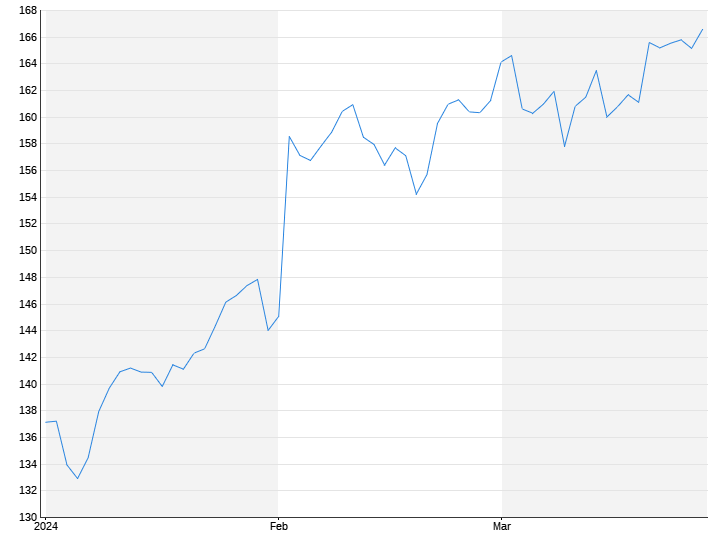

The US Federal Reserve does not want to rush its interest rate turnaround. However, investors on Wall Street were able to cope with this news quite confidently until the evening. The indices fully recoup their daily losses.

Wall Street ended trading in the evening mostly with a slight gain. According to the minutes of the most recent US Federal Reserve meeting, the indices temporarily slipped more significantly into the red, but completely made up for the losses towards the end of trading and ultimately closed with moderate gains. Only the Nasdaq Composite recorded a slight loss before the Nvidia figures after the end of trading.

At the Fed meeting at the end of January, several monetary authorities expressed their concerns about interest rate cuts being made too quickly. This confirmed investors' expectations that the Fed would take its time before cutting interest rates for the first time and that inflation would have to continue to weaken. Just last week, inflation data put a further damper on hopes of an imminent interest rate cut.

“Ultimately, my reading of the minutes is that rate cuts are still coming, they're just starting later this year,” said Paul Mielczarski, head of macro strategy at Brandywine Global. “But the case for starting rate cuts is still pretty strong. The economy doesn't have to be weak for the Federal Reserve to cut rates. It just needs to see enough evidence that inflation is moving toward the 2 percent target .”

Excitement before Nvidia numbers

The Dow Jones Index gained 0.1 percent to 38,612 points. The S&P 500 also increased by 0.1 percent. On the other hand, the technology-heavy one lost Nasdaq Composite 0.3 percent. The 1,431 (Tuesday: 1,147) price winners on the Nyse were compared to 1,411 (1,685) losers, while 56 (77) stocks left trading unchanged.

On the corporate side, interest was in Nvidia's annual figures, which were presented after the closing bell. The shares of the developer of graphics processors and chipsets have recently been strongly driven by the topic of artificial intelligence (AI) and have increased by a good 40 percent since the beginning of the year. Expectations of the numbers (and therefore the potential for disappointment) were high, so profits were taken on Tuesday. Ahead of the numbers, Nvidia's share price fell by a further 2.8 percent.

Amazon supported by Dow inclusion

Amazon increased by 0.9 percent. The e-commerce giant's shares will be included in the Dow Jones Index at the start of trading on Monday, replacing shares there Walgreens Boots Alliance (-2.5%).

Solaredge However, they fell by 12.2 percent. High interest rates and lower electricity prices caused demand for residential solar panels to decline in the fourth quarter, causing the company's revenue to shrink sharply. Furthermore, Solaredge gave a pessimistic outlook.

The figures and outlook were also met with disappointment Palo Alto Networks recorded. The IT security specialist's shares fell by 28.4 percent and also dragged down the shares of other industry companies. Crowdstrike and Zscaler were cheaper by 9.7 and 14.1 percent respectively.