Wall Street in the red

Upcoming Nvidia figures are making US investors nervous

This audio version was artificially generated. More info | Send feedback

How sustainable is the AI hype? US investors are hoping for clues from the publication of Nvidia's financial figures. The chip manufacturer, which is heavily involved in the business, has made massive gains in the last few weeks. The price is initially slipping due to profit-taking, and other tech stocks are also clearly losing ground.

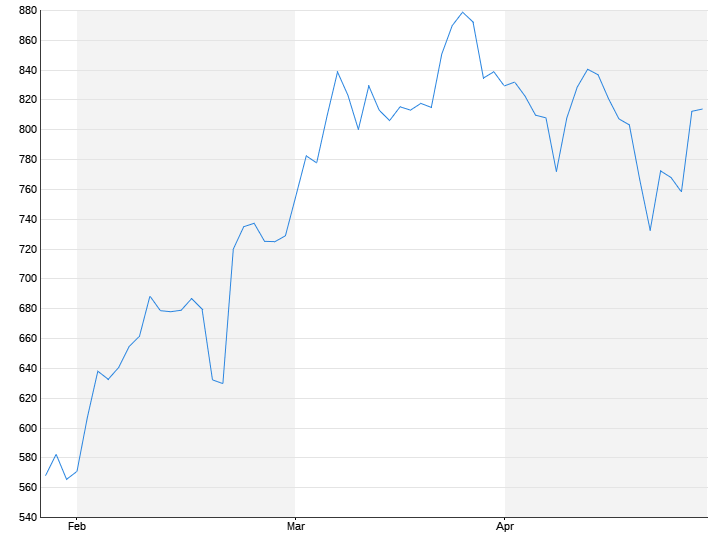

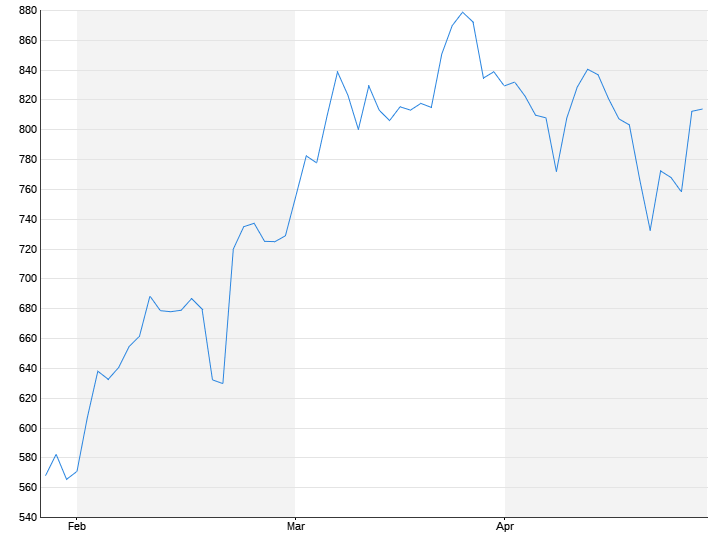

The nervousness ahead of Nvidia's numbers on Wednesday is causing problems for Wall Street. The Dow Jones Index the standard values closed 0.2 percent lower at 38,563 points. The technology-heavy one Nasdaq fell 0.9 percent to 15,630 points. The broad one S&P 500 lost 0.6 percent to 4975 points.

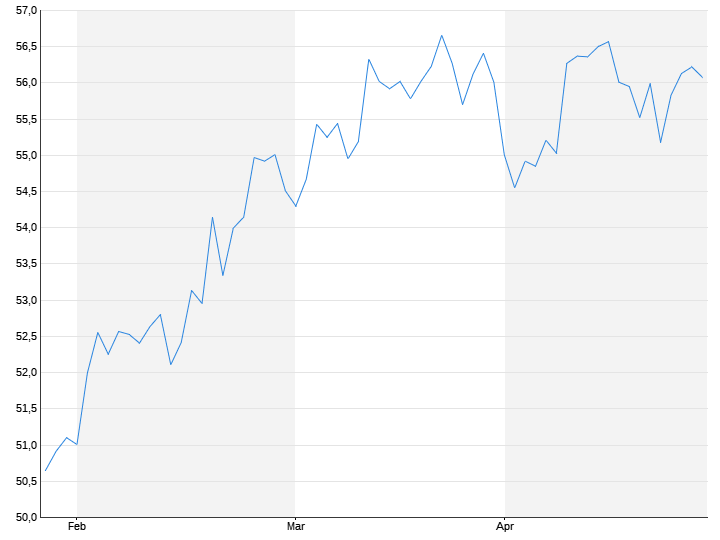

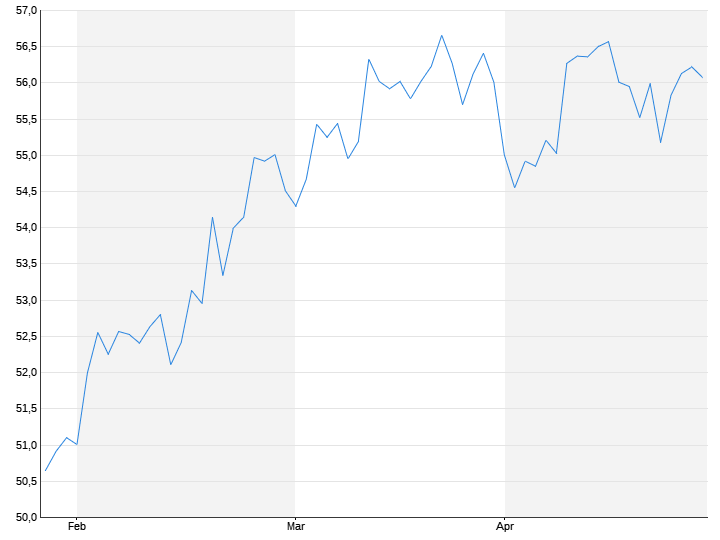

reports its fourth quarter results midweek after the US market closes. Strong demand for specialized chips for AI applications has driven the stock up by almost 50 percent since the beginning of 2024. According to analysts, the quarterly report should show how sustainable the upward potential for the popular new technology really is. “The background to the Nvidia rally, in our opinion, is a mix of fear, greed and an indiscriminate hunt by investors for everything related to AI,” wrote the experts at Bank of America. They urged caution. “One must not forget the actual performance and profits of the company.”

Profit taking depressed Nvidia before publication by more than four percent. Also rivals like AMD and Marvell lost almost five and almost two percent. “The sell-off we're seeing today actually started on Friday with profit-taking Great Micro Computers (SMCI),” said Dennis Dick, trader at broker Triple D Trading. The share of the manufacturer of computers for data centers fell by around two percent on Tuesday. At the end of last week it had slipped by more than 20 percent.

Subsidies support Intel

The only ones that were up among the technology stocks were the securities from Intel, which increased by 2.3 percent. According to a report by the Bloomberg news agency, the US government is considering subsidies worth more than ten billion dollars for the chip company.

Other individual values were in demand Walmart with a price increase of a good three percent. The US retail giant reported strong quarterly figures and announced its planned acquisition of smart TV manufacturer Vizio for $2.3 billion. The Vizio stock rose over 16 percent after publication. Vizio will give Walmart the ability to better connect with its customers and serve them in new ways with television, in-home entertainment and media offerings, it said.

However, the Chinese central bank's surprisingly large cut in the key interest rate for mortgages fizzled out on the market. In order to support the ailing real estate market and the weak economy in China, the central bank reduced the five-year reference rate – the so-called loan prime rate (LPR) – by a quarter of a percentage point to 3.95 percent. Whether and when the Chinese economy will get back on its feet remains uncertain, said Molnar. Christopher Wong, foreign exchange strategist at bank OCBC, said: “Markets are still looking for further fiscal support measures, particularly aimed at consumption.”