Attack before the Annual General Meeting

Major investors criticize Siemens Energy board

This audio version was artificially generated. More info | Send feedback

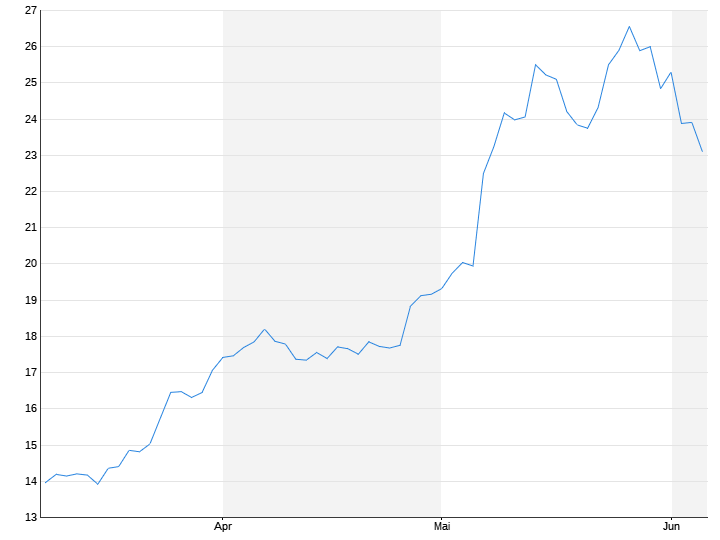

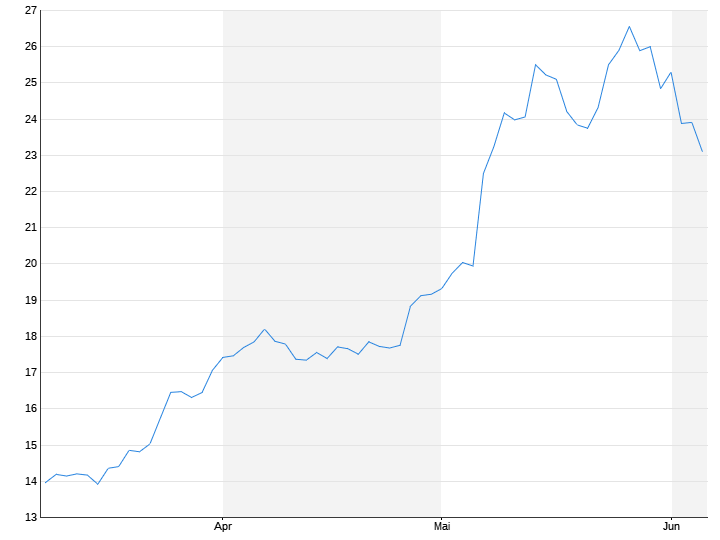

Wind power is in demand worldwide, but Siemens Energy is still deep in the red. Shortly before the Annual General Meeting, large investment companies are blaming the board for the misery: They speak of neither “forward-looking nor value-creating management”.

The two large fund companies Deka and Union Investment do not want to grant discharge to the board of the crisis-hit Siemens Energy group at the annual general meeting next week. “The drop in earnings and the support from the state show neither forward-looking nor value-creating management,” said Ingo Speich of Deka Investment to the “Handelsblatt”. Deka therefore wants to refuse to grant discharge to the board.

Union Investment is also planning this: “No other company that is still in the DAX today has caused investors such high daily losses since 2008 as Siemens Energy did last year,” fund manager Arne Rautenberg told the newspaper. The credibility of capital market communication has suffered greatly due to the ongoing problems in the wind power business. “We believe that the board is responsible for the drama surrounding (the subsidiary) Siemens Gamesa and will therefore refuse to grant it a discharge.”

Problem subsidiary Gamesa

However, industry circles are currently expecting a majority to be in favor of relief, reports the “Handelsblatt”. The energy technology provider Siemens Energy is deep in the red and made a loss of almost 4.6 billion euros in the last financial year due to problems in the wind power business. The company must be supported with state guarantees. The government argues that it is a company that is relevant to the transformation of Germany as a business location.

Siemens Gamesa is one of the largest wind turbine suppliers in the world, but has been making heavy losses for a long time. Siemens Energy took over the subsidiary entirely in 2022 after several years as majority shareholder in order to be able to take better action. Despite growing demand for clean energy, the European wind power industry is suffering from higher material prices, ongoing supply chain disruptions and strong price pressure from competition from China.