Reorganization is increasingly effective

FMC wants to grow faster

This audio version was artificially generated. More info | Send feedback

New legal form, savings and sales: the restructuring program at the dialysis group FMC is showing its first successes. Despite lower profits, shareholders want to receive more. In the current year, the company primarily wants to make operational gains.

The dialysis specialist Fresenius Medical Care wants to make significant operational gains following its separation from the parent company Fresenius. “2024 will be a year of accelerated, profitable growth,” announced CEO Helen Giza. Specifically, the group expects currency-adjusted sales growth in the low to mid-single-digit percentage range and an increase in adjusted operating profit in the mid- to high-teens percentage range.

Due to the conversion of FMC into a stock corporation (AG) at the end of last year, Fresenius no longer has to fully account for the dialysis specialist, which had increasingly become a brake on the healthcare group. However, Fresenius still holds a 32 percent share. The shortage of nursing staff in the USA in particular slowed FMC's recovery after the corona pandemic, but the company is gradually getting back on its feet. In the fourth quarter, the adjusted operating result was significantly better than analysts expected.

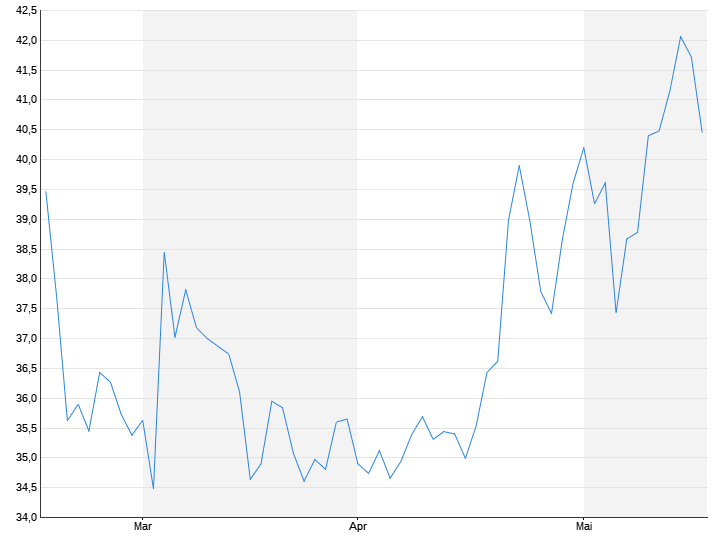

With the full-year figures, FMC exceeded its own targets. After twelve months, the adjusted operating result was 13 percent above the previous year's level at 1.74 billion euros. Adjusted for currency effects, there was an increase of 15 percent, which exceeded the FMC forecast. The group achieved its goals in November after a settlement in a legal dispute with the US government, which resulted in a positive earnings effect of 181 million euros. The company also benefits from its austerity program, which brought in more in 2023 than planned. Shareholders are to receive a six percent higher dividend of 1.19 euros per share. FMC shares

FMC achieved stable sales of almost 19.5 billion euros last year, an increase of five percent after adjusting for currency effects. The bottom line, however, was that group profits fell by more than a quarter to 499 million euros. Although the company's operational performance was better after adjusting for special effects, FMC ultimately slipped deeper into the red in the dialysis product business and the operating result in the health services business also fell by ten percent. Last year, FMC treated around 332,500 hemorrhage patients worldwide in 3,925 dialysis clinics and parted ways with 127 facilities with more than 10,000 patients.