Share price rises

Bayer shareholders welcome radical dividend cut

This audio version was artificially generated. More info | Send feedback

Despite the disastrous developments following the takeover of the glyphosate manufacturer Monsanto, Bayer pays its shareholders an impressive dividend every year. Until now. Bayer boss Anderson would rather put the billions into debt reduction.

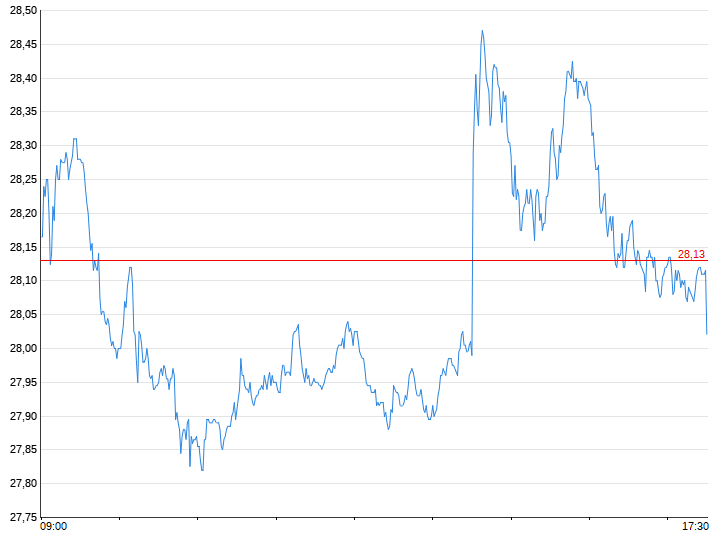

Bayer is canceling almost the entire dividend to its shareholders for three years – and has received overwhelming approval from the shareholders. The share price of the Leverkusen-based chemical group rose by around 0.7 percent in the morning after the radical dividend cut was announced – while the leading index DAX was even slightly in the red. It is apparently easy for Bayer shareholders to forego the distributions if the company as a whole and thus also the shares in it increase in value. That's exactly Bayer boss Bill Anderson's plan.

Last year, Bayer paid out a dividend of 2.40 euros per share for the previous year 2022, a total of almost 2.4 billion euros. For ten years the dividend has never been less than two euros per share. In this way, the group compensated its shareholders to a certain extent for the miserable price development of the shares. Since 2015, their value has fallen by more than 80 percent from a previous high of 141 euros to a low of just 27.40 euros a few weeks ago. This loss of value was accompanied by the takeover of the American agricultural chemical company Monsanto. The deal turned out to be a financial disaster. With its weed killer glyphosate, Monsanto brought billions in risks to the company in the form of claims for damages from customers suffering from cancer. Sales and profits, however, fell short of expectations. Bayer is now sitting on 35 billion euros in debt – with rising interest rates.

Bayer's management around the CEO, who will be replaced in 2023, pursued the strategy of keeping payouts high despite this development in order to demonstrate reliability to shareholders and not allow the share price to plummet. Measured against the current share price, Bayer offered impressive dividend returns in these years. For many investors, the focus of a so-called dividend strategy is on such a reliable distribution and less on the price development of a share.

“Best short-term solution”

But at Bayer, this strategy no longer worked from the shareholders' perspective. The loss of value of the shares could obviously no longer be stopped. The entire company is currently worth less than half of what Bayer once paid to take over Monsanto. In order to turn things around, Baumann's successor Anderson wants to invest the billions that have so far flowed annually to shareholders into debt reduction. Under German law, a company cannot simply cancel the dividend completely. If a stock corporation makes a profit, the shareholders are entitled to a minimum claim of four percent of the share capital. In Bayer's case, this results in a minimum dividend of eleven cents. Bayer wants to pay that this year and the next two years, but not a cent more.

According to analyst Martin Schnee from Baader Bank, cutting the dividend is the “best short-term solution” for Bayer. However, in addition to the low share price, shareholders paid the price for poor management decisions. However, CEO Anderson will first have to prove whether he will be able to turn things around after years of decline, for example by soon presented a comprehensive strategic realignment for Bayer.

Anderson wants to attend Bayer's Capital Markets Day on March 5th will present his plans for the future of Bayer. Investors expect him to carry out a fundamental review of the structures – the demands extend to a complete split-up of the group, which also includes the pharmaceutical and agricultural businesses. According to insiders, Anderson initially wants to take less radical measures, such as introducing the new operating model, with which he wants to reduce hierarchies, streamline structures and speed up decisions.