“Position consolidated”

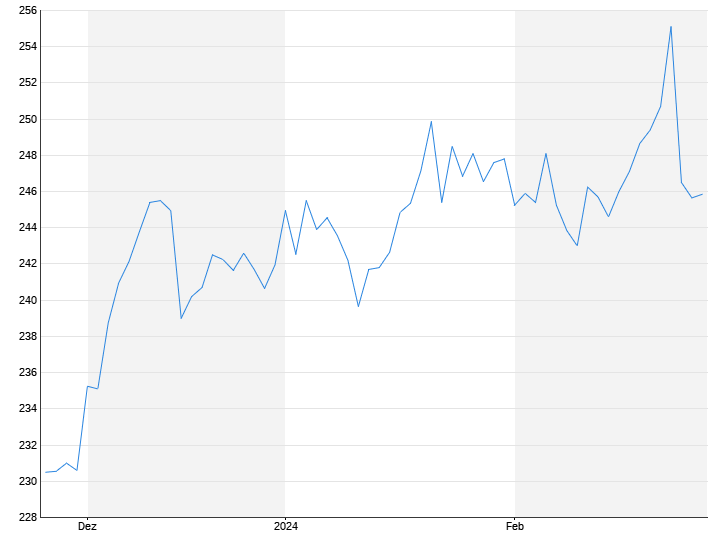

Allianz is rushing to the next record – higher payouts

This audio version was artificially generated. More info | Send feedback

After another record year, the insurance giant Allianz wants to let its shareholders participate more in its success. The dividend is rising sharply. The group also buys back its own securities. However, the forecast for the current year does not exclude a lower result.

Allianz has had another record year and wants to let shareholders participate more in its profits in the future. The insurance group's operating result rose by seven percent to 14.7 billion euros last year and was, as expected, in the upper half of the target range, as the insurer announced in Munich. This time the profit driver was life and health insurance, which benefited primarily from accounting effects in the USA.

“Allianz has consolidated its leadership position as one of the most robust global insurers and active asset managers,” said CEO Oliver Bäte. For the current year, he is targeting an operating result of 13.8 billion to 15.8 billion euros. Profits after third-party shares rose by a third to 8.5 billion euros. The year before, billions in costs for the “Structured Alpha” affair surrounding the sale of hedge funds in the USA had burdened the balance sheet.

The dividend will increase by 2.40 euros to 13.80 euros per share because Allianz wants to distribute a larger part of its profits to shareholders in the future, as it had already announced the evening before. Analysts had on average only expected a dividend of around twelve euros. From now on, 60 instead of 50 percent of the net profit after third-party shares adjusted for special effects should be paid as a dividend, but at least as much as in the previous year. Allianz is also launching a new one-billion-euro share buyback program.

Money flows into asset managers

The insurance giant can afford these distributions: the solvency ratio of 206 (201) percent is more than twice as high as absolutely necessary, even after the dividend distribution. “The disciplined implementation of strategy and capital management underpins our operational profit outlook for 2024, our new dividend policy and our new share buyback program,” said Bäte.

The total business volume rose by 5.5 percent to 161.7 billion euros last year. Without currency effects and takeovers, there would even be an increase of eight percent. The property and casualty division recorded the strongest growth, benefiting primarily from price increases of almost seven percent. But it also suffered from natural disasters, which caused the combined ratio to rise to 93.8 percent.

In life and health insurance, the new CFO Claire-Marie Coste-Lepoutre spoke of “solid” new business. The division's operating result rose by almost one billion euros. In asset management, currency effects reduced earnings by almost two percent, and the operating result also shrank slightly. At the end of the year, Allianz managed 1.71 trillion euros for third-party customers, 77 billion more than twelve months earlier. 21.5 billion euros flowed into the Pimco and AllianzGI funds, and rising prices and exchange rates increased the volume by 104 billion.