Dow rally continues

Tesla and Netflix are hurting the Nasdaq

This audio version was artificially generated. More info | Send feedback

The quarterly financial statements of Tesla and Netflix are not causing any enthusiasm among investors; the shares are falling significantly, dragging down the Nasdaq. The Dow, on the other hand, achieved its ninth daily gain in a row.

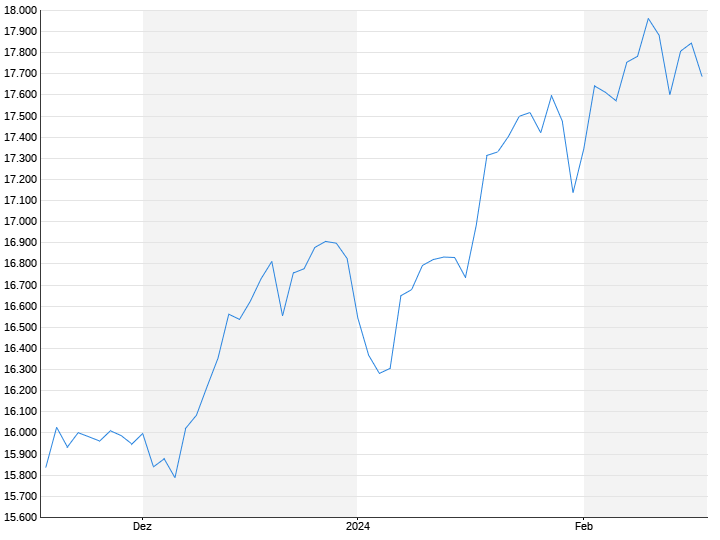

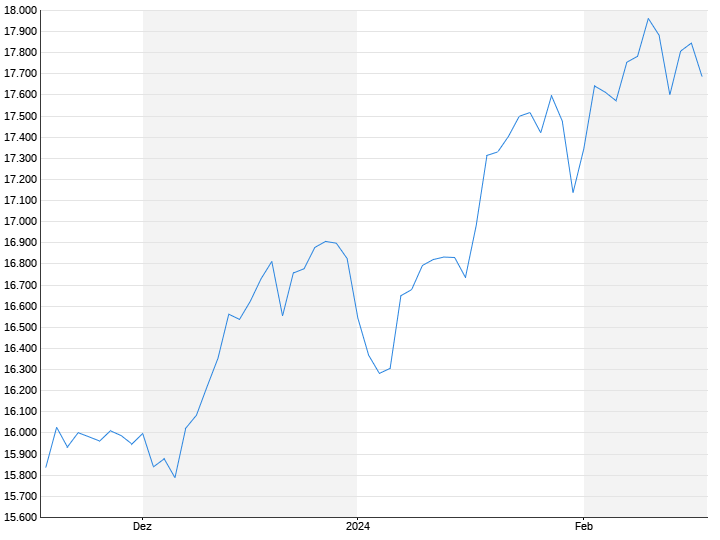

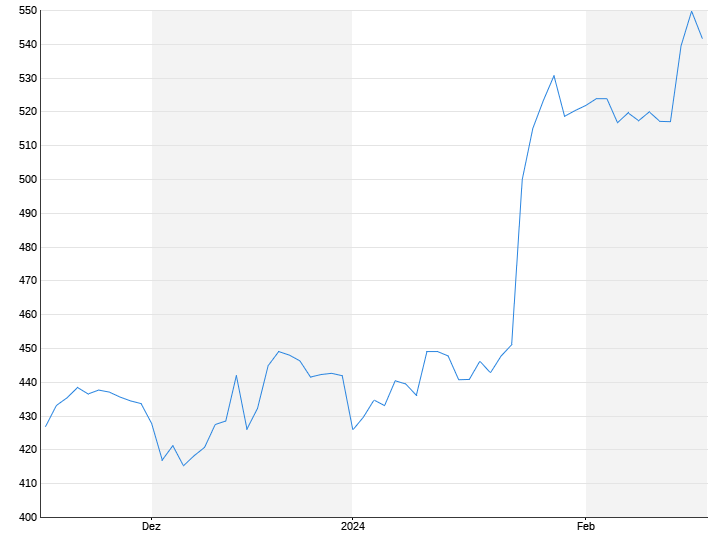

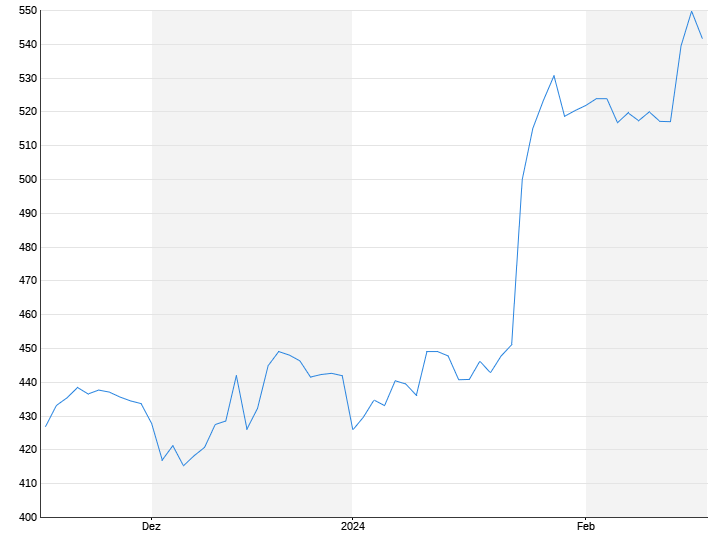

Disappointing business results from Tesla and Netflix spooked US technology investors on Thursday. Cautious statements from SAP regarding cloud sales also weighed on the sector. The Nasdaq index closed 2.1 percent weaker at 14,063 points. The broad one S&P was trading 0.7 percent weaker at 4,534 points at the close of trading. The Dow Jones Index The standard values, on the other hand, gained 0.5 percent to 35,225 points, thus achieving its ninth daily gain in a row. This is the longest winning streak in almost six years.

“The Dow has simply been neglected in the recent rally of growth stocks, and now people are putting their money back into some of the stocks that aren't known for their growth,” said David Russell of financial services provider TradeStation.

With a loss of 9.7 percent, they belonged Tesla shares to the losers. The head of the electric car manufacturer, Elon Musk, signaled further price cuts. “He opened a whole new barrel with the price cuts,” said Michael Matousek, chief trader at US Global Investors. “We will see more manufacturers offering their vehicles more competitively because electric cars recently had a very high profit margin and they now simply have the opportunity to reduce prices.”

Netflix Papers fell 8.4 percent. “Netflix shares have historically been driven by sentiment and narrative rather than fundamentals,” said David Trainer, head of financial services provider New Constructs. “But for everyone who values numbers and data, it is clear: Netflix is heavily overvalued and a very risky investment.”

Those listed in the USA SAP shares closed 6.4 percent in the red. Europe's largest software house reduced its cloud sales from the upper end of the target range this year to 14.2 from 14.4 billion euros.

The pharmaceutical company's shares, on the other hand, were up 6.1 percent Johnson & Johnson at the top of the Dow. The pharmaceutical company increased its forecast in view of the strong demand for cancer drugs and good business with medical technology. Also the papers from United Airlines were among the winners with an increase of 3.2 percent. The airline also raised its profit forecast. Despite the rising cost of living, the demand for travel remains unbroken. At the same time, capacity is still lower than before the corona pandemic. This is the basis for better results in the aviation industry, said United boss Scott Kirby. He was in Frankfurt Dax It closed 0.6 percent higher at 16,204 points.