Investors: year to forget

Nestle is experiencing customer reluctance

This audio version was artificially generated. More info | Send feedback

The Swiss food giant Nestle is once again selling less. Price increases are also offset by currency fluctuations. However, the group earns significantly more due to special effects. And there is good news for consumers too.

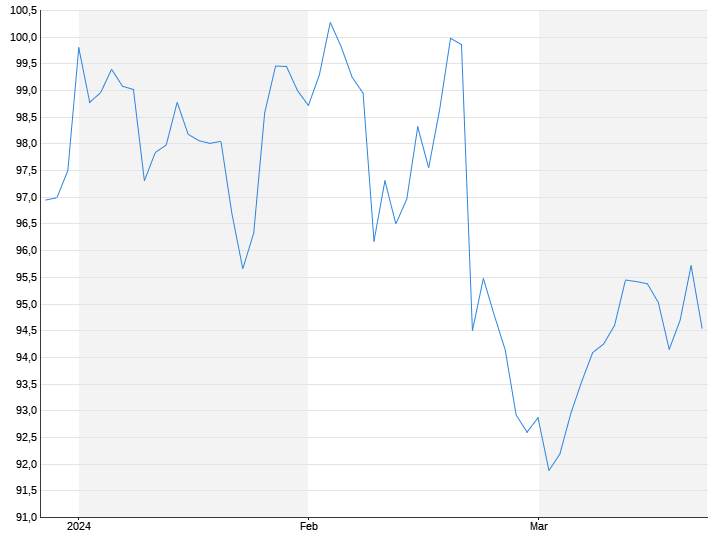

Sharp price increases last year spoiled consumers' appetite for products from food giant Nestle. Sales of the manufacturer of Nespresso, Maggi, KitKat and Perrier fell by 1.5 percent to 93 billion francs, as the Swiss food giant announced. The price increases were practically eaten up by unfavorable exchange rates. For the second year in a row, Nestle sold fewer products.

The decline in sales, which attracted much attention from investors, accelerated to 2.5 percent in the previous year. “The unprecedented wave of inflation of the past two years put a strain on many consumers and dampened demand for food and beverages,” explained CEO Mark Schneider.

Despite the sluggish business, profits increased significantly and rose by a fifth to 11.2 billion francs. The reasons were, among other things, lower impairments of property, plant and equipment and lower taxes. According to a survey conducted by the group itself, analysts had expected an average profit of 12.1 billion francs and sales of 93.7 billion francs for 2023. Nestle wants to increase the dividend to 3.00 francs per share.

On the stock exchange, Nestle shares fell in early trading and were thus at the bottom of the Swiss standard stocks. “A year to forget for Nestlé,” said Vontobel analyst Jean-Philippe Bertschy. The relatively weak volume growth and the self-inflicted problem in the Nestlé Health Science division left a bitter aftertaste. Nestle must take measures to give the company new impetus.

Nestle expects organic sales growth of four percent for the current year. This key figure includes the development of sales volumes, the product mix and price adjustments. After increases of 7.5 percent last year, Nestle wants to raise prices much more cautiously in 2024. “Growth this year will be much more based on volume and mix,” explained Schneider. The adjusted earnings margin is expected to increase slightly from 17.3 percent in 2023. The group continues to aim for a return to an adjusted margin of 17.5 to 18.5 percent by 2025.