No dividend

Fresenius has tightened up – earnings are increasing

This audio version was artificially generated. More info | Send feedback

The healthcare group has realigned itself. The focus is on the Helios clinical division and the Kabi medication division. The dialysis subsidiary FMC, which had recently become an increasing burden, has been removed from the balance sheet. With this trim, the DAX group sees itself back on track.

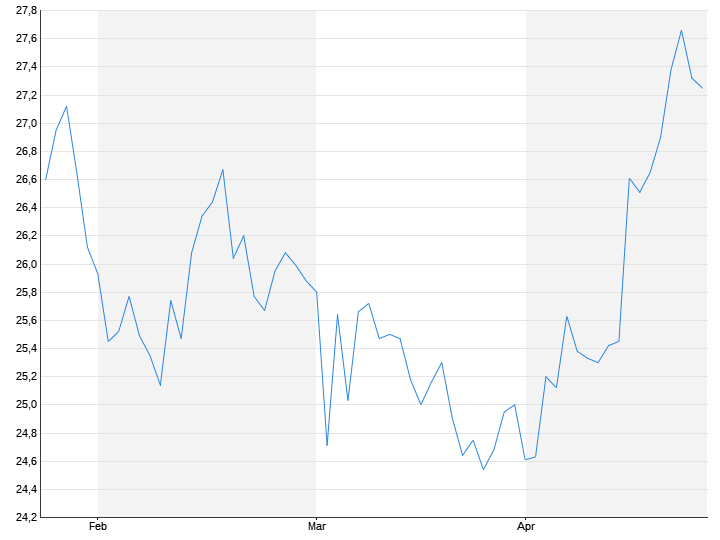

CEO Michael Sen's restructuring of the company has gotten Fresenius back on track. “In the 2023 financial year, we set a decisive course and got Fresenius back on track,” said Sen. “We will use this momentum to further expand our business and accelerate the earnings growth of the operating companies Fresenius Kabi and Fresenius Helios.” The healthcare group earned almost 2.3 billion euros operationally (EBIT), an increase of three percent. In the previous year, when the dialysis subsidiary FMC was still fully included in the balance sheet, the result had fallen. In the final quarter, it significantly exceeded analyst expectations.

Sen is aiming for accelerated earnings growth this year: the operating result should increase between four and eight percent after adjusting for currency effects. Organic sales growth is expected to be between three and six percent. Overall, sales climbed by four percent to 22.3 billion last year.

Fresenius completed the unbundling of FMC at the end of November. Due to a change in the legal form of the dialysis specialist, Fresenius no longer has to fully account for the subsidiary. During the corona pandemic, FMC increasingly became a brake on the company, which had long been spoiled for success: more dialysis patients died than usual, and the company was also hit hard by a shortage of nursing staff.

Fresenius' results have only gone downwards since 2020. Although things were going smoothly again operationally, the bottom line in 2023 was a loss of 594 million euros after a profit of 1.37 billion euros a year ago, mainly due to high value adjustments as a result of exchange rate losses at FMC, in which the group still owns 32 percent holds.

Sen sold numerous peripheral businesses last year, such as the Eugin fertility clinic chain. Fresenius is to concentrate on the Kabi drug division and the Helios clinic chain. Like the ailing service division Vamed, which Sen also cleaned up, FMC will only be managed as a financial investment. Meanwhile, shareholders will have to forego a dividend, as Fresenius had already announced in December. The group does not want to repay state subsidies for energy costs of up to 300 million euros for the Helios hospitals and wants to use the funds to reduce debt. This means that the company is not allowed to pay dividends for 2023 or pay bonuses to managers.