Bad mood due to new data

Economic concerns push US stock markets into the red

This audio version was artificially generated. More info | Send feedback

After the long holiday weekend, the US stock markets are heading down significantly. New economic data is making investors doubt that the US industry will have a soft landing. The Nasdaq is losing particularly heavily.

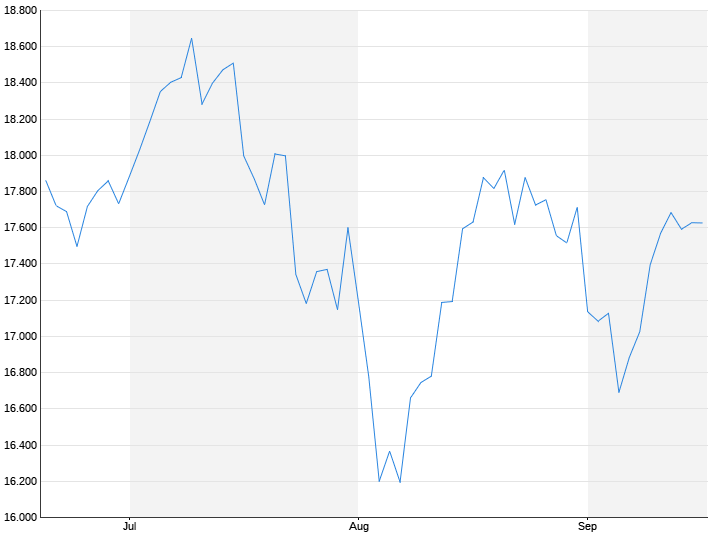

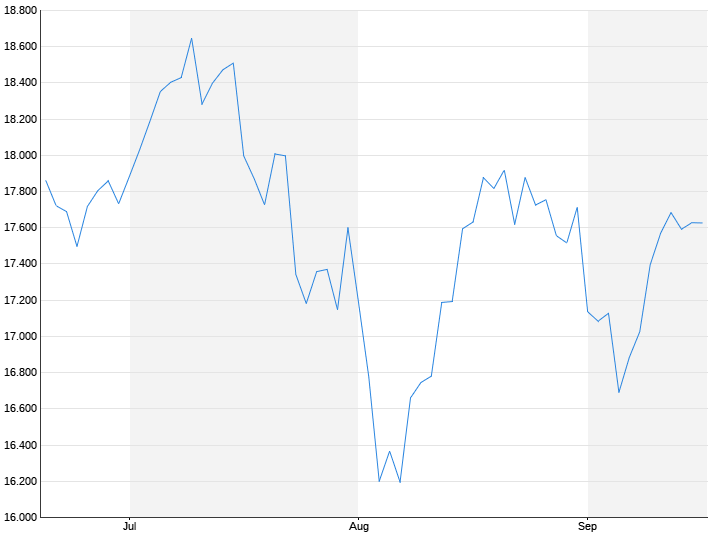

Weak data from the US industry have hit Wall Street hard. Dow Jones Index of the standard values closed on Tuesday 1.5 percent lower at 40,936 points. The technology-heavy Nasdaq fell 3.3 percent to 17,136 points and the broad S&P500 2.1 percent to 5,528 positions.

The purchasing managers' index for US industry, which rose by 0.4 points in August compared to July, caused a bad mood. At 47.2 points, the barometer remained well below the growth threshold of 50 points. Economists had expected an increase to 47.5 points. “If we are hoping for a soft landing for the US economy, these numbers are certainly not what we wanted to see,” said Josh Jamner, strategist at asset manager ClearBridge.

Stock market traders are now waiting for the US labor market data due later in the week. They hope to use these to determine whether the US Federal Reserve will initiate the expected interest rate turnaround with a cut of half or a quarter of a percentage point. “The markets are currently assuming a cut of 25 basis points, with the chance of 50 basis points being estimated at 20 percent,” said Konstantin Oldenburger, analyst at broker CMC Markets. “The US labor market report on Friday could finally swing this pendulum in one direction or the other.” Investors are also hoping for clues from the US data on job vacancies on Wednesday and on unemployment claims on Thursday. The monetary authorities around Fed Chairman Jerome Powell are trying to curb inflation and cool down the overheated labor market by raising interest rates.

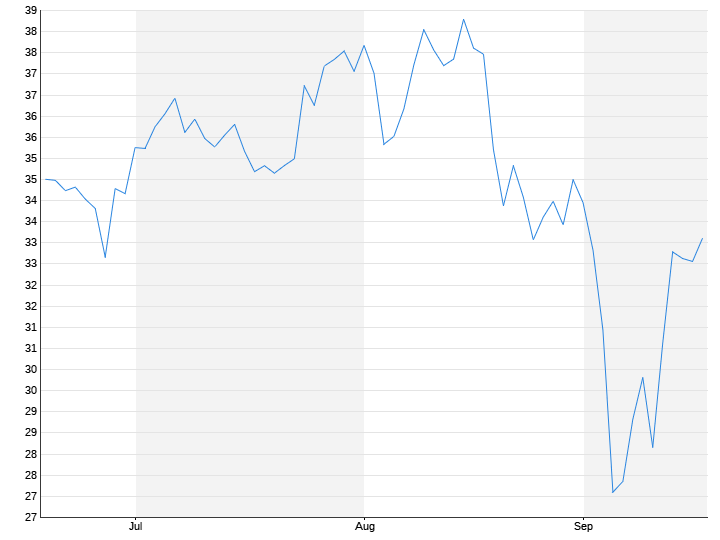

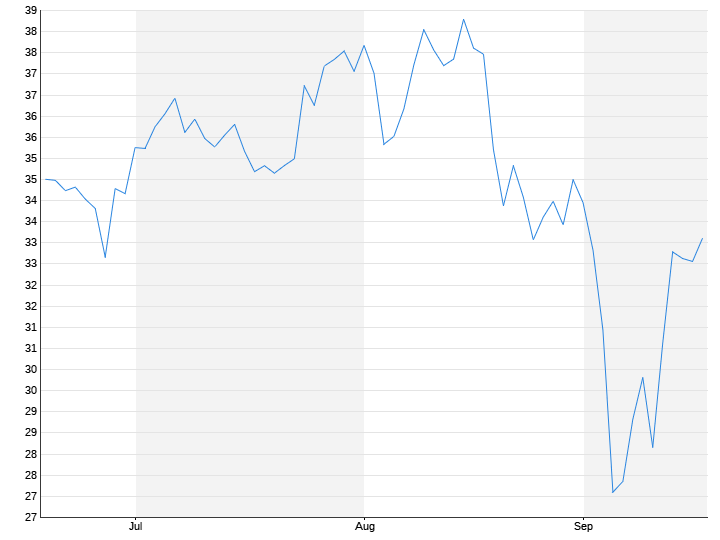

Oil prices in the basement

A media report about a possible end to the production bottlenecks in Libya pushed oil prices to their lowest level since December. The North Sea crude oil Brent and the US variety WTI fell by around five percent to 73.66 and 70.31 dollars per barrel (159 liters). Giovanni Staunovo, an analyst at the Swiss major bank UBS, also attributed the sell-off to a report by the Bloomberg agency. According to the report, an agreement is imminent to settle the political dispute that has recently halted oil production in Libya and the exports of the important producer.

The spotlight was on companies US Steelwhich fell by more than six percent. Democratic presidential candidate Kamala Harris had expressed her concern about the takeover of the steel company by the Japanese company Nippon Steel.

Also flying from the depots were BoeingThe shares of the crisis-hit aircraft manufacturer slipped by around seven percent. Experts at financial services provider Wells Fargo downgraded them to “Underweight” from “Equal Weight”. One of the reasons for this is the increased aircraft development costs, which could jeopardize the group's cash flow targets.

A negative comment from the US investment bank Morgan Stanley pushed down the shares of Google's parent company alphabet by 3.7 percent to 157.36 dollars. The experts had lowered the price target to 190 from 205 dollars previously. The background to this was the possible long-term consequences of the ruling of a US judge in early August. Against the general market trend, Southwest Airlines by 2.3 percent to 29.58 dollars. The experts at the investment bank Evercore had rated the shares “outperform” after previously “in-line”. The price target was also raised to 35 from 30 dollars.

You can read everything else about today’s stock market events here.