Only a few cents per share

Bayer cuts dividend for shareholders

This audio version was artificially generated. More info | Send feedback

The pharmaceutical and agrochemical company Bayer is cutting its dividend for the next three years to the legal minimum. The company's debt level and high interest rates are cited as reasons for this. And major changes could soon be on the horizon in Leverkusen.

Bayer is also cutting its dividend under the financial pressure of billion-dollar US legal disputes. For three years, only the legally required minimum will be paid out, the pharmaceutical and agrochemical company announced shortly before the stock market closed. For 2023, this would result in a dividend of EUR 0.11 per share, which will also be proposed to the Annual General Meeting in April. The cuts are related to the debt level, high interest rates and a tense situation with regard to free cash flow.

“Reducing our debt and increasing our flexibility are among our top priorities,” said Bayer CEO Bill Anderson, according to the statement. The new dividend policy, which also incorporates suggestions from investors, should help with this. Bayer's share price initially fluctuated sharply, but then closed trading with a gain of over one percent, slightly above the price before the statement.

Bayer is currently in a difficult situation. The wave of lawsuits in the USA over alleged cancer risks from weed killers containing glyphosate has been keeping the company busy for years and has already swallowed up billions. Analysts also see major financial risks from PCB lawsuits in the USA, an environmental toxin that has been banned for decades.

Monsanto takeover has an impact

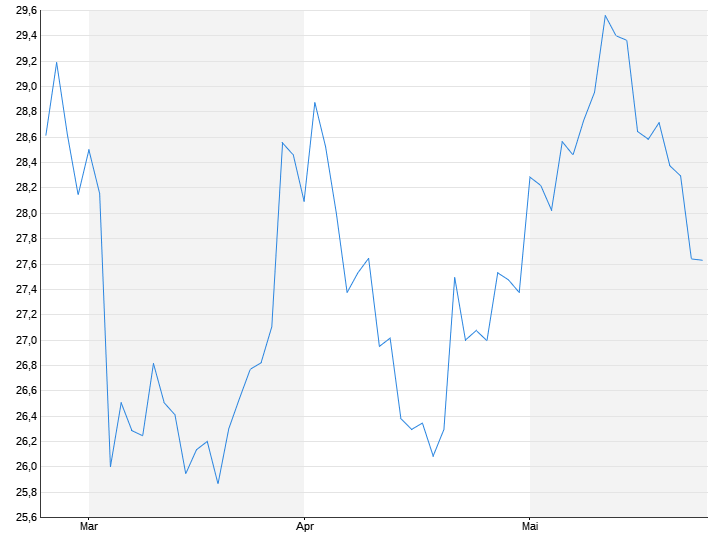

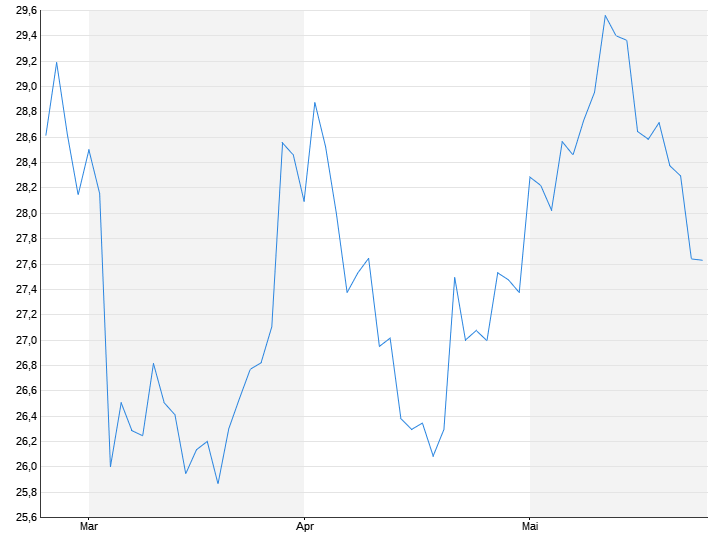

Both are a legacy of the US agrochemical company Monsanto, which was acquired in 2018 for over 60 billion US dollars and which the then Bayer CEO Werner Baumann pushed through despite resistance from quite a few investors. After years of falling share prices, the company is currently only worth 28.4 billion euros on the stock market.

To make matters worse, Bayer's previous best-in-class drugs will bring in less and less money as patents gradually expire, with no similarly lucrative successor drugs in sight. At the end of 2023, an important study on a drug that was supposed to help close the gap flopped.

In view of all these problems, the dividend cut is a small piece of positive news for experts. Further extensive strategic measures are needed to repair the balance sheet. One such measure – which is also being discussed within the group – could be the sale of part of the company, either in full or in part. According to experts, however, in the current environment, only the Consumer Health division, which deals with over-the-counter medications, is likely to be considered.

Analysts and shareholders are therefore looking forward to the beginning of March with great anticipation. That is when Bayer CEO Bill Anderson, who only took over the helm in June 2023, plans to present his plans for the future of the Leverkusen-based company.