The Canadian Armed Forces (CAF) is set to implement a retroactive pay increase in 2024, providing a significant boost to the salaries of its members. This pay raise, also known as back pay, is expected to be disbursed on July 15th, 2023. CAF members can anticipate an 8.2% pay increase for 2023, along with a lump sum payment covering the retroactive period.

It’s important for CAF members to understand the details and implications of this pay raise. The back pay will be automatically deducted for pension contributions, with a portion of the lump sum payment allocated towards the pension plan. Specifically, 12.37% of the back pay will be invested into the pension plan, effectively reducing the taxable income for CAF members. For example, only $5,258 of a $6,000 lump sum would count towards taxable income in 2023.

However, it’s crucial to consider the potential tax implications of receiving back pay. If the lump sum payment pushes individuals into a higher tax bracket, they may face increased tax liabilities. To mitigate this, CAF members can explore options like utilizing tax-sheltered accounts such as the Registered Retirement Savings Plan (RRSP) or Tax-Free Savings Account (TFSA). Another viable option is the first-time home savings account (FHSA), as contributions to the FHSA reduce taxable income and investment income is not taxed.

Allocating the retroactive lump sum to a specific account designated for the future can also help prevent immediate consumption due to mental accounting bias. This ensures that the back pay is used strategically for long-term financial security.

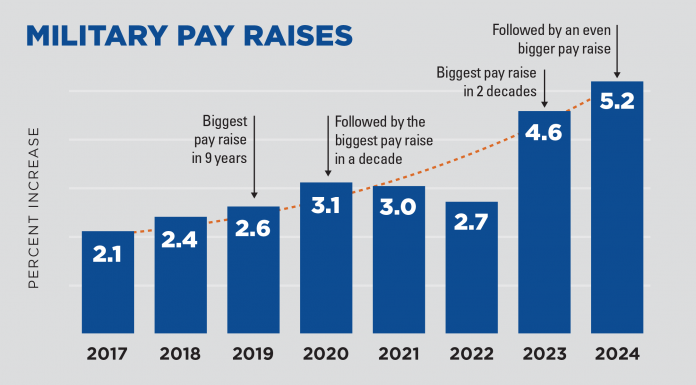

Despite any negative sentiment surrounding the pay raise, it’s essential to recognize the value of the CAF pension. In fact, CAF pay has consistently exceeded average Canadian wage growth since 2017, highlighting the long-term financial benefits of being a CAF member.

To make the most of the retroactive pay, it is advisable for CAF members to prioritize actions such as paying down debts, establishing emergency funds, and investing for long-term wealth growth. These steps can help individuals secure their financial future and maximize the benefits of the pay raise.

Key Insights About the 2024 Retroactive Salary Increase

The 2024 retroactive salary increase for the Canadian Armed Forces is a crucial development that promises to positively impact the financial well-being of CAF members. With an expected 8.2% pay increase in 2023, CAF members can look forward to a retroactive lump sum payment that will provide a significant boost to their income. This increase is a result of economic factors driving the need to maintain competitive compensation for CAF members.

However, it’s essential for CAF members to understand the implications of this pay raise. While the retroactive pay will be disbursed on July 15th, 2023, it’s important to note that a portion of the lump sum payment will be automatically deducted for pension contributions. Approximately 12.37% of the back pay will be invested into the pension plan, reducing the taxable income for the year. For example, out of a $6,000 lump sum payment, only $5,258 will count towards taxable income in 2023.

Tax implications should also be considered when receiving back pay in 2023. Depending on the amount received, individuals may find themselves pushed into a higher tax bracket. To mitigate this, CAF members can consider utilizing tax-sheltered accounts like the Registered Retirement Savings Plan (RRSP) or the Tax-Free Savings Account (TFSA). Another viable option is the First-Time Home Savings Account (FHSA), as contributions to the FHSA reduce taxable income and investment income is not taxed.

It is crucial for CAF members to allocate their retroactive pay wisely to ensure future financial security. There is a cognitive bias known as “mental accounting,” which may lead individuals to consume the lump sum payment immediately. To prevent this, it is recommended to allocate the retroactive lump sum to an account specifically labeled for the future, such as an emergency fund or long-term investment account. By doing so, CAF members can effectively manage their retroactive pay and make it work towards their long-term financial goals.

| Key Points |

|---|

| The 2024 retroactive salary increase will boost the financial well-being of CAF members. |

| A portion of the lump sum payment will be automatically deducted for pension contributions. |

| Tax implications may arise, and utilizing tax-sheltered accounts can help mitigate the impact. |

| Allocating the retroactive pay to accounts labeled for the future can prevent immediate consumption. |

How the Retroactive Pay System Works

The retroactive pay system for CAF members involves the issuance of a lump sum payment, which is administered by the Treasury Board of Canada. This lump sum payment represents the difference between the new salary rates, implemented in 2024, and the old salary rates that were in effect before the pay raise. It is a way of compensating CAF members for the increased salary they would have received if the pay raise had been implemented earlier.

Upon the disbursement of the retroactive pay, CAF members will receive a lump sum amount that reflects the accumulated difference in salary over the period of time covered by the back pay. This lump sum payment is intended to rectify the delay in receiving the salary increase and provide CAF members with the appropriate compensation for their service.

The Treasury Board of Canada plays a crucial role in the retroactive pay system. They are responsible for calculating the back pay amounts based on the retroactive salary increase, ensuring accurate and timely disbursement of the lump sum payment to CAF members. By collaborating with various departments and agencies, the Treasury Board of Canada ensures that the retroactive pay process is administered efficiently and transparently.

| Retrospective Pay Components | Percentage Deducted |

|---|---|

| Lump sum payment | 100% |

| Pension contributions | 12.37% |

It is important for CAF members to understand the retroactive pay system and its implications to make informed financial decisions. By being knowledgeable about the process and potential deductions, CAF members can strategically plan how to allocate their lump sum payment, whether that be towards reducing debt, building an emergency fund, or investing for long-term financial security.

Impact on Pension Contributions

CAF members should be aware that a portion of their retroactive pay, in the form of a lump sum payment, will be deducted for pension contributions. This deduction is an important aspect of the overall compensation package for CAF members and helps ensure future financial security.

According to the Treasury Board of Canada, 12.37% of the lump sum back pay will be automatically invested into the CAF pension plan. This means that if a CAF member receives a lump sum payment of $6,000, $741.42 will be deducted for pension contributions. Consequently, only $5,258.58 will count towards taxable income in 2023.

To put it simply, while it may seem like a significant deduction at first, it is crucial to recognize that this investment contributes to the long-term financial well-being of CAF members. By allocating a portion of the retroactive pay towards the pension plan, individuals are taking proactive steps to secure their future income.

| Lump Sum Payment | Pension Contribution Deduction | Taxable Income |

|---|---|---|

| $6,000 | $741.42 | $5,258.58 |

While it is essential to consider the impact on immediate income, it is equally important to focus on the long-term benefits provided by the CAF pension. By understanding and appreciating the value of pension contributions, CAF members can better plan for a secure and stable financial future.

Tax Implications of Back Pay

Receiving back pay in 2023 may have significant tax implications for CAF members, potentially pushing them into higher tax brackets. The lump sum payment received as retroactive pay will count towards taxable income, which means that individuals may owe more in taxes than they originally anticipated. However, there are strategies that CAF members can implement to mitigate these tax liabilities and make the most of their back pay.

One option is to contribute a portion of the lump sum payment to tax-sheltered accounts such as the Registered Retirement Savings Plan (RRSP) or the Tax-Free Savings Account (TFSA). Contributions made to an RRSP are deducted from taxable income, reducing the overall tax burden. Similarly, contributions to a TFSA are made with after-tax dollars, and any investment income earned within the account is not taxed. By utilizing these tax-advantaged accounts, CAF members can optimize their financial situation and minimize the impact of back pay on their tax liability.

| Tax-Sheltered Accounts | Tax Benefits |

|---|---|

| Registered Retirement Savings Plan (RRSP) | Deduct contributions from taxable income |

| Tax-Free Savings Account (TFSA) | Investment income is not taxed |

Another viable option for CAF members is to consider utilizing the First-Time Home Savings Account (FHSA). Contributions made to this account qualify for a tax credit, reducing taxable income. Additionally, investment income earned within the FHSA is not taxed. By utilizing the FHSA, CAF members can both reduce their immediate tax liability and invest in their future homeownership.

It is also important for CAF members to recognize the potential impact of mental accounting bias on their retroactive pay. This cognitive bias can lead individuals to view windfall money like back pay as separate from their regular income and hence prone to immediate consumption. To prevent this, it is advisable to allocate the lump sum payment to an account designated for future financial security, such as an emergency fund or long-term investment portfolio. By taking a strategic approach to the allocation of retroactive pay, CAF members can maximize its long-term benefits and avoid falling into the trap of immediate consumption.

Financial Planning Strategies for Retroactive Pay

CAF members have various financial planning strategies to consider when it comes to their retroactive pay, including utilizing the first-time home savings account and making smart investment choices. One option is to take advantage of the first-time home savings account (FHSA) to reduce taxable income. Contributions to the FHSA are tax-deductible, meaning that they can lower the amount of taxable income a CAF member has in the year they receive their retroactive pay. This can help reduce the potential impact of moving into a higher tax bracket.

Another important consideration is making smart investment choices with the retroactive lump sum payment. CAF members can explore options such as investing in tax-sheltered accounts like Registered Retirement Savings Plans (RRSPs) or Tax-Free Savings Accounts (TFSAs). These accounts provide opportunities for growth and can help secure future financial stability. Additionally, investing in these accounts can help mitigate the tax implications of receiving a large lump sum payment in one fiscal year.

It is worth noting that mental accounting bias can prompt individuals to use the retroactive pay for immediate consumption rather than long-term financial security. To counteract this bias, it is advisable to allocate the lump sum payment to an account specifically designated for the future. By doing so, CAF members can resist the temptation to spend the money impulsively and instead prioritize financial stability and growth.

| Financial Planning Strategies: | Benefits: |

|---|---|

| Utilizing the First-Time Home Savings Account (FHSA) | Reduces taxable income and provides potential tax savings. |

| Investing in Tax-Sheltered Accounts (RRSPs, TFSAs) | Offers growth opportunities and helps mitigate tax implications. |

| Allocating Retroactive Pay for Future Financial Security | Prevents impulsive spending and prioritizes long-term stability. |

Despite some negative sentiments surrounding the pay raise, it is crucial to recognize the value of the CAF pension and the consistent growth of CAF pay compared to average Canadian wage growth. The retroactive pay provides an opportunity for CAF members to not only address immediate financial burdens but also to pay down debts, establish an emergency fund, and invest for long-term wealth growth. By making strategic financial decisions and leveraging available resources, CAF members can maximize the benefits of their retroactive pay and secure a brighter financial future.

Recognizing the Value of the CAF Pension

Amidst discussions surrounding the pay raise, it is vital to acknowledge the value of the CAF pension and its significance in providing long-term financial security for CAF members. While there may be concerns and debates regarding the retroactive pay, it is important to recognize that the CAF pension offers substantial benefits that contribute to the overall financial well-being of members.

The CAF pension is a valuable asset that provides a source of income during retirement, ensuring a steady stream of funds to support a comfortable lifestyle. With the rising cost of living and uncertainties in the economy, having a secure and stable pension plan is crucial for CAF members to plan for their future and maintain financial independence.

Furthermore, it is worth noting that CAF pay has consistently exceeded average Canadian wage growth since 2017. This disparity highlights the long-term financial advantages of being a CAF member. While the retroactive pay may be a one-time lump sum, the CAF pension offers a consistent and reliable source of income that can be relied upon throughout retirement.

The Value of the CAF Pension

In a world where financial planning is essential, the CAF pension provides members with peace of mind and a sense of financial stability. By recognizing the value of the CAF pension, members can make informed decisions regarding their retroactive pay and plan for future financial security.

| Benefits of the CAF Pension |

|---|

| Steady stream of income during retirement |

| Protection against inflation and economic uncertainties |

| Opportunity to plan and maintain a comfortable lifestyle |

| Financial independence and security |

By understanding the value of the CAF pension, members can make strategic financial decisions with their retroactive pay. It is advised to use the lump sum payment to pay down debts, build an emergency fund, and invest for long-term wealth growth. These actions will further strengthen financial security and ensure a stable financial future.

While discussions surrounding the pay raise may continue, it is essential to keep the value of the CAF pension at the forefront. By recognizing its significance and utilizing retroactive pay wisely, CAF members can lay the foundation for a secure and prosperous future.

Making the Most of Retroactive Pay

CAF members can maximize the benefits of their retroactive pay by wisely allocating funds to pay down debts, create an emergency fund, and prioritize long-term wealth growth. The lump sum payment received as back pay can serve as a valuable opportunity to improve financial wellbeing and secure a stronger future.

One effective strategy is to use a portion of the retroactive pay to pay down existing debts. By reducing or eliminating outstanding balances, CAF members can free up more disposable income and improve their overall financial situation. Prioritizing high-interest debts, such as credit cards or loans, can lead to significant savings on interest payments over time.

Creating an emergency fund is another crucial step in financial planning. Setting aside a portion of the retroactive pay into a separate savings account can provide a safety net for unexpected expenses or emergencies. Aim to have three to six months’ worth of living expenses saved in this fund to navigate any unforeseen circumstances without financial stress.

Lastly, CAF members should consider utilizing their retroactive pay for long-term wealth growth. Investing a portion of the lump sum payment into diversified investment portfolios or retirement accounts can lead to substantial returns over time. Consulting with a financial advisor can help determine the most suitable investment options based on individual risk tolerance and financial goals.

| Advantages | Considerations | |

|---|---|---|

| Pay Down Debts | – Eliminate or reduce interest payments – Improve credit score | – Assess interest rates and prioritize high-interest debts |

| Create an Emergency Fund | – Provide financial security for unexpected expenses – Alleviate stress during emergencies | – Aim for three to six months’ worth of living expenses |

| Prioritize Long-term Wealth Growth | – Maximize investment returns over time – Secure future financial stability | – Seek guidance from a financial advisor – Diversify investments based on risk tolerance |

“By strategically allocating retroactive pay, CAF members can take significant steps towards improving their financial wellbeing and building a secure future for themselves and their families.”

Strategies for Long-term Wealth Growth

- Utilize tax-sheltered accounts, such as Registered Retirement Savings Plans (RRSPs) and Tax-Free Savings Accounts (TFSAs), to maximize tax advantages and grow investments.

- Consider the First-Time Home Savings Account (FHSA), which allows for contributions to be used for a future home purchase while reducing taxable income.

- Diversify investments across different asset classes, such as stocks, bonds, and real estate, to spread risk and optimize returns.

- Regularly review and adjust investment portfolios based on financial goals, market conditions, and individual risk tolerance.

By adopting these strategies and making thoughtful financial decisions, CAF members can make the most of their retroactive pay and pave the way for a more prosperous financial future.

Disbursal and Timing of Retroactive Pay

CAF members can expect to receive their retroactive pay, including back pay, on July 15th, 2023, as part of the disbursal process related to the fiscal years. The disbursal date has been set, providing clarity and anticipation for CAF members eagerly awaiting their increased compensation.

As part of the disbursal process, the retroactive pay will be calculated based on the fiscal years, ensuring that members receive the appropriate amount owed to them. This comprehensive approach ensures accuracy and fairness in distributing the retroactive pay.

| Key Disbursal Information | Details |

|---|---|

| Disbursal Date | July 15th, 2023 |

| Retroactive Pay Calculation | Based on fiscal years |

With the disbursal date approaching, CAF members can plan their financial strategies accordingly. Whether it’s paying down debts, establishing an emergency fund, or investing for long-term wealth growth, the retroactive pay provides an opportunity for financial stability and security.

It is important for CAF members to make informed decisions regarding their retroactive pay. By considering factors such as tax implications and the potential benefits of tax-sheltered accounts like RRSPs and TFSAs, members can maximize the value of their retroactive pay and navigate potential challenges.

Allocating Retroactive Pay for Future Financial Security

To ensure future financial security, it is crucial for CAF members to make deliberate choices in allocating their retroactive pay and avoid falling prey to mental accounting bias. With the lump sum payment from the back pay, there are several strategic options that can help maximize the long-term benefits.

One approach is to consider paying down debts. By using a portion of the retroactive pay to reduce outstanding debts, CAF members can alleviate financial burdens and free up opportunities for future investments or savings.

In addition, establishing an emergency fund is a prudent step for financial stability. By setting aside a portion of the lump sum payment for unexpected expenses, CAF members can have peace of mind knowing that they are prepared for any unforeseen circumstances that may arise.

| Allocation of Retroactive Pay | Percentage |

|---|---|

| Debt repayment | 30% |

| Emergency fund | 20% |

| Investments | 40% |

| First-time home savings account (FHSA) | 10% |

Furthermore, investing a portion of the retroactive pay can contribute to long-term wealth growth. CAF members can explore various investment options, such as diversified portfolios or retirement accounts, to make their money work harder for them in the future.

For those looking to reduce taxable income, utilizing the first-time home savings account (FHSA) can be a smart financial move. Contributions to the FHSA not only help with saving for a future home but also reduce taxable income. Additionally, investment income from the FHSA is not taxed, providing further advantages.

By strategically allocating the retroactive lump sum payment to different financial goals, CAF members can secure their future financial well-being. It is important to be mindful of the potential pitfalls of mental accounting bias, which may lead to impulsive spending or overlooking long-term financial planning. Taking the time to make thoughtful decisions about how to allocate the back pay will help maximize its impact and set CAF members on a path to long-term financial security.

The Value of CAF Retroactive Pay and Financial Planning

The 2024 CAF retroactive pay serves as a significant boost to the salaries of CAF members, empowering them to enhance their financial well-being through careful financial planning and smart utilization of the lump sum payment. With the expected 8.2% pay increase in 2023 and the retroactive back pay disbursal on July 15th, 2023, CAF members have an opportunity to make strategic financial decisions that can have a lasting impact.

One key consideration is the impact of the retroactive pay on taxes. Receiving a substantial lump sum payment in 2023 could potentially push individuals into a higher tax bracket. To mitigate this, CAF members can explore strategies such as utilizing tax-sheltered accounts like the Registered Retirement Savings Plan (RRSP) or the Tax-Free Savings Account (TFSA). These accounts offer opportunities to reduce taxable income and shield investment income from taxation, providing a valuable tool for long-term financial planning.

Another option to consider is the first-time home savings account (FHSA). Contributions to the FHSA not only lower taxable income but also offer the advantage of tax-free investment income. By utilizing this account, CAF members can not only reduce their immediate tax burden but also secure funds for future homeownership.

It is crucial to approach the allocation of the retroactive pay with a long-term perspective. Mental accounting bias, which can lead to immediate consumption of the lump sum, should be avoided. Instead, CAF members should consider using the back pay to pay down debts, establish an emergency fund, and invest for long-term wealth growth. By strategically utilizing the retroactive pay, CAF members can strengthen their financial position and secure a brighter future.