Large western oil companies are strengthening themselves with billion-dollar takeovers and purchases of fossil competitors. Is this appropriate for the times? The author and financial market expert Heike Buchter stood at the first fracking towers in the USA in 2011. Five years ago, she predicted an “oil earthquake” in her book of the same name. ntv.de spoke to her about “a remarkable resurrection” and a “new self-confidence” in an industry that was already in decline.

ntv.de: Big Oil is on a massive shopping spree, with one billion-dollar takeover after another. We are in the midst of a transformation away from fossil fuels. What is happening here?

Heike Buchter: We see indeed a remarkable resurrection of the oil industry. During the pandemic, when demand for oil collapsed completely, the industry had to pay for someone to buy oil from them at times. Including storage costs, oil prices were negative. At the time, people believed that oil production would only go downhill…

This was the peak oil moment that people had been waiting for for a long time. The end of oil seemed closer than ever.

Yes. And suddenly they are all back. Business is booming. Exxon has presented the most spectacular result in its history with 56 billion US dollars in 2022. Big Oil is brimming with self-confidence. Buying up companies, mergers and acquisitions are nothing else.

Where are we now?

The fact is: The USA is the largest oil producer in the world. No country in the world has ever pumped as much oil as the Americans did in December. That was 13.3 million barrels a day. No one could have imagined that it would ever happen again. The USA pumps more than the Saudis and more than the Russians, and is also the largest gas producer. America is back in full force.

It was clear that oil would not disappear overnight. But How can this 180-degree turn be explained?

Unique things have happened in recent years. When demand collapsed during the pandemic, it simply fit well into the green narrative of the energy transition to pretend that we no longer needed oil. Then the industry recovered, production started up again – and it was thirsty for oil. Oil is still essential in many areas. Especially for emerging countries like China and India. Then came the Ukraine war and the Russia sanctions. We suddenly needed oil from other sources. Prices went through the roof and gave the oil companies buoyant profits. At that point it was clear: Big Oil was never really gone. They can now use the money they earned to finance their takeovers.

The European competition seems more cautious. Is this impression misleading?

The oil companies were never really out of the picture. The British oil company Shell is also investing heavily in fossil projects again. But there is one difference: European companies like BP and Shell have made more efforts in alternative energies in recent decades than their competitors in the USA and have invested a lot. This was also due to pressure from governments in Europe. The US giants Exxon and Chevron, on the other hand, have consistently said that we will stick to what we are good at: oil and gas. We are not solar or wind. This was also against the trend on Wall Street. Investors and shareholders turned away because it was not the future that people wanted to hear at the time. Exxon also made its own mistakes, such as a spectacular bad investment in fracking gas, and was heavily in debt. That's over! Today Exxon is suing its shareholders, who are climate activists. The bosses say that more climate, transparency and reducing emissions are damaging the company. Not so long ago, that would have been considered a damage to its image! So times have changed.

Does that mean we are heading full speed back to the fossil age?

Financial market expert Heike Buchter has been reporting from Wall Street since 2001. In 2019, her book “Ölbeben” was published, in which she addresses the US energy dominance.

(Photo: Heike Buchter, photographer Stefan Falke)

No. The oil companies are not that blind. No one is saying that this will last forever. Climate change has not been forgotten. Everyone in the oil industry is aware of this, the Saudis as well as the Americans. Demand will shrink, perhaps at some point it will no longer be there at all. The only question is when? And what will happen until then? Every oil company wants to squeeze out every last drop of profit until the end. They want to be the “last man standing”. The boss until the end.

Given the climate targets we have, this seems to be a rather ineffective strategy. Does this slow down the energy transition?

No, not really. The USA is also adding huge amounts of renewable energy. Ultimately – and we should be honest about this – the future of how much oil will be produced does not depend on the oil companies, but largely on us, the consumers. As long as we demand oil, the oil companies cannot be blamed for much. We decide. If Chevron or Exxon don't pump the oil, then someone else will. Is it better if the Saudis do it?

There is an unexpectedly gigantic oil deposit off the coast of small Guyana in South America, which Exxon is currently exploiting. How important is this oil in a time of multiple crises?

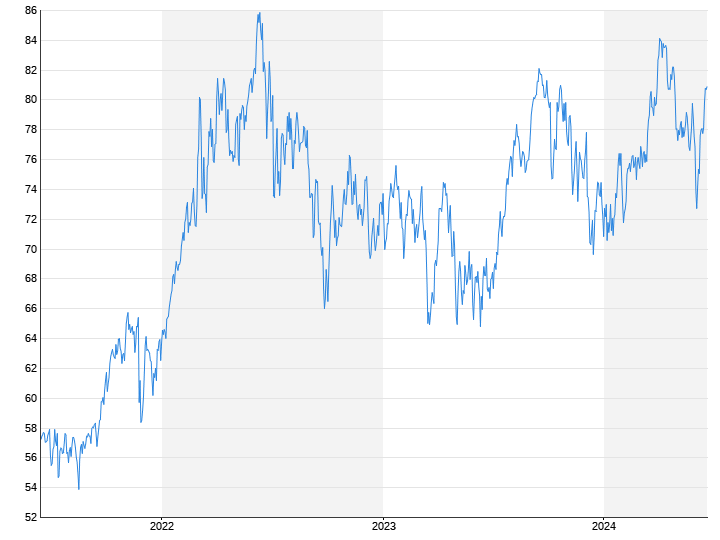

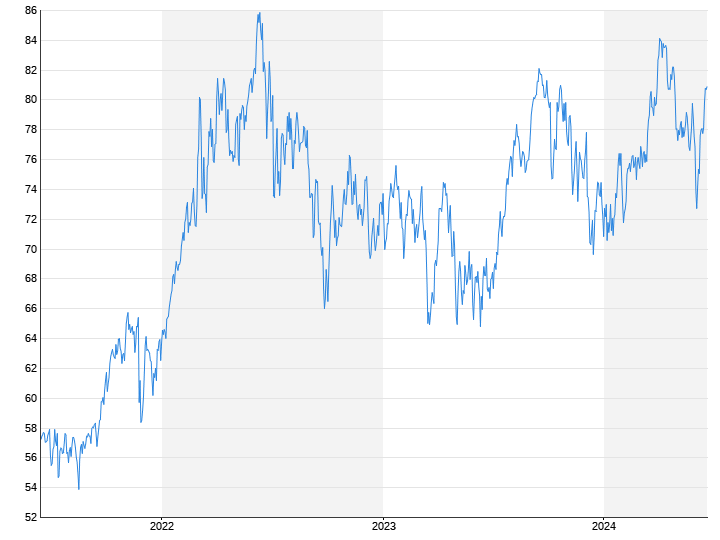

The discovery in Guyana is extremely important. For us in Europe too! When there was a crisis in the Middle East in the past, oil prices rose enormously. Now we have war in Israel. The Houthis, who sympathize with the Palestinians, are firing on oil tankers in the Red Sea. Oil prices should really be going through the roof. But they aren't. Before the war with Israel began, North Sea Brent oil cost 85 US dollars per barrel. In mid-December, the price was 73 US dollars. The price of oil has fallen in one of the biggest crises in the Middle East. Why? Because thanks to fracking in Texas and production in Guyana, everyone is relaxed. Thanks to the Americans and their oil and gas giants, we are no longer so dependent on the markets in crisis areas.

What role does fracking play in this final spurt until the last drop of oil has dried up?

Fracking is extremely important for the last-man-standing strategy. Drilling in the Arctic is an incredible effort. It can take up to a decade for the plant to be set up and the first drop of oil to flow. Fracking can be implemented more quickly, in months, not years. The oil dries up more quickly, but it is cheaper and can be better tailored to demand. If we both pool our savings and borrow from friends, we could rent a rig, a drilling tower, and set it up on a leased site somewhere in Texas and drill for oil there. That is of course exaggerated. (laughs) But fracking operations are relatively manageable. Oil giants like Exxon were therefore not interested in the topic for a long time. Today, fracking is much more sophisticated, much more efficient. And unlike the fracking pioneers, often so-called wildcatters, who are not least driven by enthusiasm for the search, the large corporations have access to the capital market, they don't have to beg for money, they can spend big.

In your book “Oilquake”, which came out in 2019, you addressed the renaissance of the oil age. The reason was the fracking boom and Donald Trump, who wanted to promote everything that had to do with oil and gas in order to make America great again. It looks like not only Big Oil is coming back, but possibly Trump too. Is the dream of the green turnaround?

Trump is not ideological and he is not an idiot. He will definitely not cut off his fans and friends' money for any projects, no matter how sensible or not they may be. There is no need to worry about that. Trump will not go and say that the battery plant in Michigan, which is being built with subsidies from Washington, will not be built. Because that would affect his voters. From Obama to Trump, Biden and now possibly Trump again – all US governments have promoted everything. Whether oil, gas, solar or geothermal energy. That's America. No US president has ever strangled anything that promotes the economy. George W. Bush, for example, ensured that Texas is now the largest provider of wind energy. Oklahoma, where oil is almost more powerful than in Texas, is investing in wind energy. Solar energy is also being expanded. America not only has the energy, but above all the generous capital to generate it. And the corporations use that. As it suits them.

Diana Dittmer spoke with Heike Buchter