Competitiveness suffers

The euro is stronger than ever

This audio version was artificially generated. More info | Send feedback

A year ago the euro exchange rate against the US dollar was at a 20-year low. The common currency has now become significantly more expensive – compared to the currencies of the most important trading partners, it has never been more expensive.

Relative to the currencies of the eurozone’s most important trading partners, the euro is stronger than ever. The Nominal Effective Exchange Rate (NEER), calculated by the European Central Bank, is an index value that represents the value of the common currency against a basket of currencies weighted by trading volume. The NEER is currently above 125 points, the highest value recorded so far. When the euro was introduced, initially as book money, in 1999, the NEER started at 100 points.

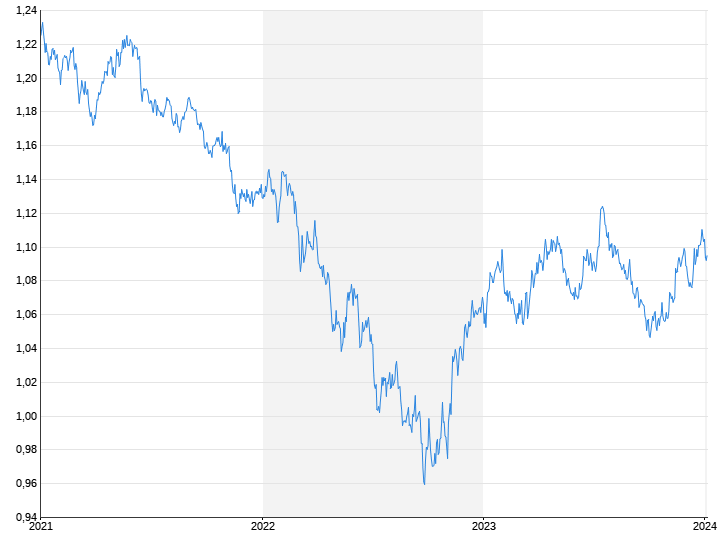

A year ago, the euro made headlines with its weakness, especially against the US dollar. In the summer and autumn of 2022, the euro was quoted below $1.00 for months. In September, one euro temporarily cost just 95 cents, the lowest level in 20 years. Since then, the euro has appreciated by more than 15 percent against the US currency. The euro also appreciated significantly against the Chinese yuan and reached its highest price in more than three years a few days ago.

The strong currency is a double-edged sword for the European economy. On the one hand, the appreciation of the euro in recent months has helped to calm inflation. Imported goods from other currency areas, especially energy raw materials such as oil and gas quoted in dollars, become cheaper for the euro countries. On the other hand, the competitiveness of European products is suffering. Goods manufactured in Germany or other euro countries have become significantly more expensive for customers in the USA, China and other important sales markets outside the euro zone. This is particularly felt by the export-oriented German industry, which at the same time has to contend with increased costs, particularly for energy.

Experts see another trend reversal

The reason for the trend reversal in the relationship between the euro and the dollar and other important currencies is the delayed interest rate policy of the respective central banks. In the fight against inflation, the American Federal Reserve began raising key interest rates much earlier than the ECB. This – combined with robust growth in the USA – caused the dollar to appreciate during this time. However, while the Fed is currently taking a break again and the markets are speculating that the peak of inflation and the rise in interest rates has been passed in the USA, further interest rate increases are expected in Europe. Higher interest rates in a currency area tend to increase demand for that currency on the foreign exchange market.

However, according to experts, the trend on the foreign exchange market could soon reverse again. In view of recently weak economic data from the euro area and declining inflation in the monetary community, the ECB is also likely to at least slow down its interest rate hikes. Experts surveyed by Bloomberg assume on average that the euro exchange rate is likely to fall to $1.10 in the short term.

The strong euro is likely to be a topic at the ECB interest rate meeting next Thursday. It is certain that the central bank will raise the key interest rate again. However, the exchange rate and the gloomy economic outlook could help to reduce expectations for further increases.