Nvidia under pressure

Wall Street is keeping an eye on the US economy

This audio version was artificially generated. More info | Send feedback

While investors are still digesting chip giant Nvidia's quarterly figures, Wall Street's attention is already turning to the possible interest rate turnaround in September. The US economy is growing faster than expected. That's good for stocks.

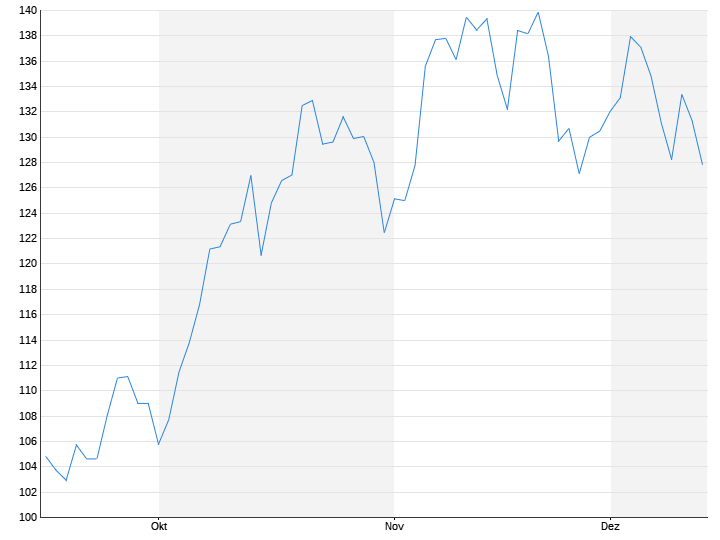

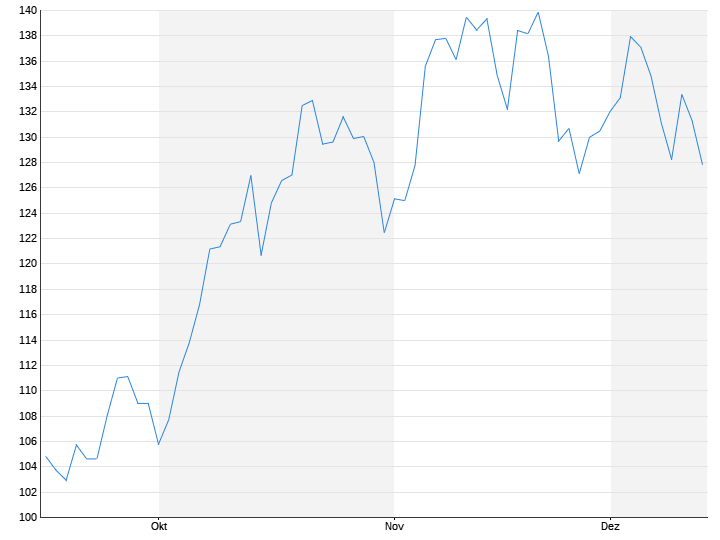

Wall Street closed mixed in the evening in a volatile environment. The S&P 500 and the technology-heavy Nasdaq index completely gave up significant premiums in late trading. The Dow Jones Index closed 0.6 percent higher at 41,335 points. The S&P 500 closed almost unchanged during the Nasdaq Composite fell by 0.2 percent. There were a total of 1,875 (Wednesday: 1,042) price winners and 910 (1,729) losers. 77 (97) titles closed unchanged.

The focus was primarily on the technology sector after the quarterly figures Nvidiawhich turned out better than expected, with sales and profits each more than doubling. However, the outlook was not convincing. This affected both the sales forecast and the outlook for the gross margin. The forecasts also showed a slowdown in growth compared to previous quarters, it said. The new chip generation (“Blackwell”) will also go into series production a quarter later than planned. Nvidia shares then fell sharply by 6.4 percent. The semiconductor sub-index in the S&P 500 fell by 3.7 percent.

Waiting for price data on Friday

After Nvidia's figures, the market's attention is now increasingly focused on the US economic data and its effects on the US Federal Reserve's monetary policy, it was said in the trade. It should be exciting on Friday. Then the PCE deflator of US consumer spending is on the agenda in August.

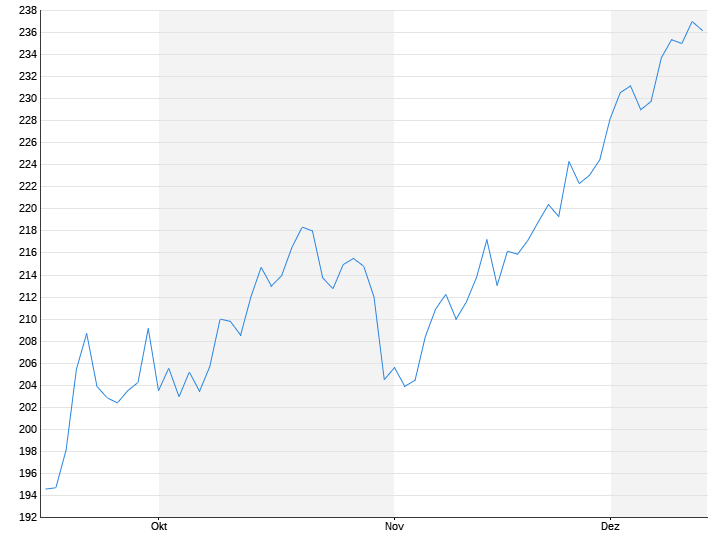

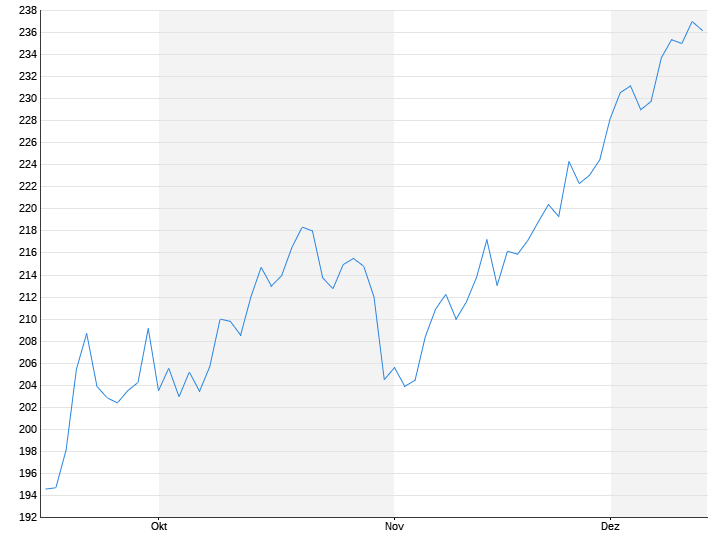

On the economic side, economic growth in the USA was slightly higher in the second quarter than previously expected. The price-adjusted gross domestic product (GDP) increased compared to the previous quarter at an annualized rate of 3.0 percent. In the first reading, an increase of 2.8 percent was reported. In contrast, the weekly initial applications for unemployment benefits showed almost a perfect landing. Compared to the previous week, they fell by 2,000 to 231,000. Economists had predicted a decline to 230,000.

Dollar recovery continues – oil prices are rising again

On the foreign exchange market, the dollar slightly extended its previous day's gains, continuing its recent recovery after recently falling to its lowest level in 13 months. The dollar index rose by 0.3 percent. Economic data released on Thursday suggests the Federal Reserve will cut interest rates less aggressively than some participants expect, supporting the dollar, Validus Risk Management said. “There is some uncertainty in the market as to whether the Fed will cut rates by 25 basis points or 50 basis points at the September meeting, and today's data supports a 25 basis point cut.”

On the bond market, yields continued their upward movement following the economic data. The data gives investors reassurance that the US Federal Reserve probably does not need to aggressively cut interest rates, it said. The yield on ten-year papers increased by 3.0 basis points to 3.87 percent.

Oil prices have now risen again after the latest taxes. Prices for Brent and WTI rose by up to 1.9 percent. The better-than-expected GDP data is driving up prices as it indicates higher energy demand, it said.

The price of gold rose 0.7 percent to $2,522. Demand from investors and central banks remains strong and the long-term outlook remains positive, said Hani Abuagla, senior market analyst at XTB MENA. Of course, one cannot rule out a correction or profit-taking, but in the long term gold still looks good and can protect against the volatility of other assets.

Apple with premiums – HP shares fall

Apple (+1.5%) is apparently banking on the success of its first iPhones with artificial intelligence (AI). The US company has instructed its suppliers to prepare components and parts for around 88 to 90 million smartphones, the Nikkei Asia newspaper reported, citing informed people. According to sources, Apple is also in discussions about investing in OpenAI. The move would cement ties with a partner essential to Apple's efforts to gain ground in the AI race. The investment would come as part of a new OpenAI funding round that would boost the ChatGPT developer's valuation to over $100 billion, people familiar with the matter said.

Sales, profit and operating margin of the SAP competitor Salesforce (-0.7%) exceeded expectations in the second quarter. The company also raised its outlook. HP (+2.0%) increased sales slightly more than expected in the third quarter, but profits fell and missed the consensus estimate.

Crowdstrike rose by 2.8 percent. The company earned more than expected in its fiscal second quarter but cut its full-year targets and gave a pessimistic outlook for the current quarter. Crowdstrike's second quarter went better than feared, despite the company being hit by one of its worst IT outages ever, UBS said.

You can find everything else about today's stock market events here.