Crash after high-flying

Nvidia stock market value suffers record crash

This audio version was artificially generated. More info | Send feedback

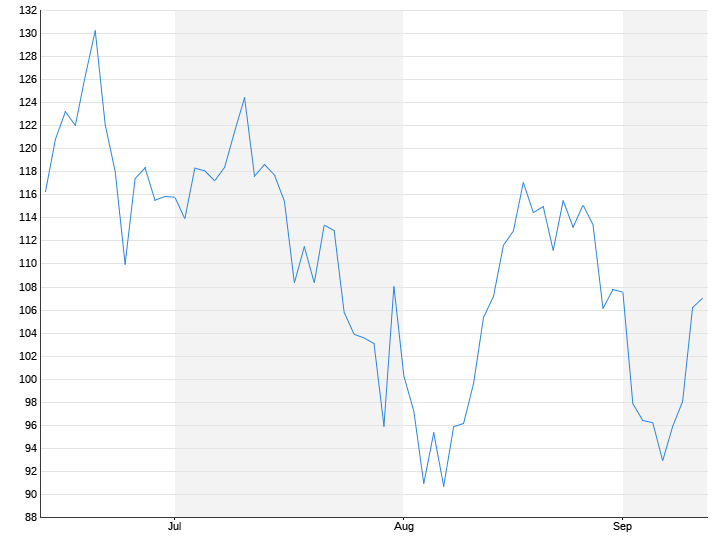

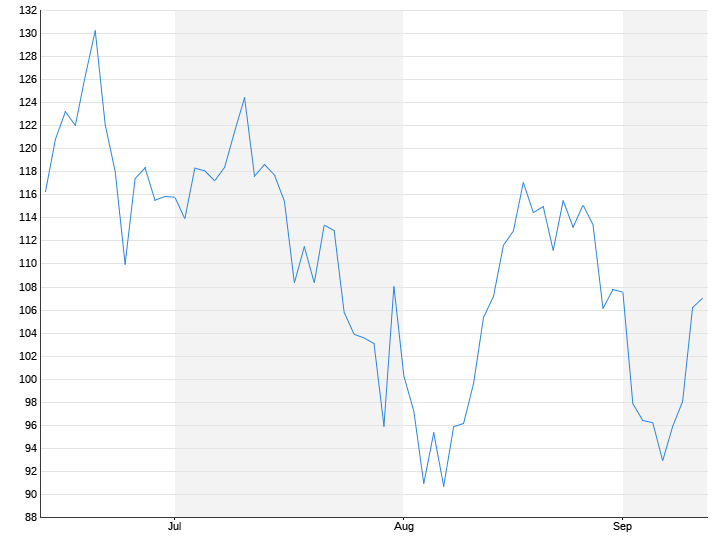

For months, Nvidia's market value has only known one direction: up. But the big AI hype seems to be over. After a disappointing quarterly forecast, the chip manufacturer's share price has plummeted. A report on antitrust investigations is adding to the pressure.

The market value of AI chip manufacturer Nvidia fell by $279 billion on Tuesday. No US company has ever lost so much market value in one day. Observers interpreted this as a sign that investors are becoming more cautious about technologies related to artificial intelligence (AI). AI has contributed significantly to the price gains on the US stock markets this year. Nvidia presented a quarterly forecast last week that did not meet investors' high expectations.

Nvidia shares lost 9.5 percent in a weak market environment. In after-hours trading, Nvidia also fell another 2.4 percent. The trigger was a report from Bloomberg that the US Department of Justice had subpoenaed Nvidia and other companies to find evidence that the chip manufacturer had violated antitrust laws. Antitrust officials feared that Nvidia was making it more difficult for customers to switch to other providers.

After the share price had mostly only known an upward direction since the beginning of 2023 in the wake of the AI hype, Nvidia's market value has multiplied since then and cracked the three trillion dollar mark for the first time in early June. At that time, the company had overtaken Apple and was only ahead of Microsoft.

Nvidia share price triples in 2024

Accordingly, a strong percentage loss in Nvidia's share price is now reflected in losses in the three-digit billions in market value. The last time there was a similarly high loss within one day was in early February 2022, when Facebook's parent company Meta Platforms lost $232 billion in market value after a weak forecast.

The PHLX chip index lost 7.75 percent on Tuesday. That was its biggest daily decline since 2020. Concerns that the high investments in AI could only pay off slowly have weighed on Wall Street's most valuable companies in recent weeks. Shares in Microsoft and Google parent Alphabet traded lower after their quarterly reports in July.

“So much money has flowed into technology and semiconductor stocks over the past 12 months that trading is completely distorted,” said Todd Sohn, ETF strategist at Strategas Securities. Experts at fund provider BlackRock wrote in a note to clients on Tuesday that some recent studies cast doubt on whether revenues from AI alone would justify the wave of investment in the technology.