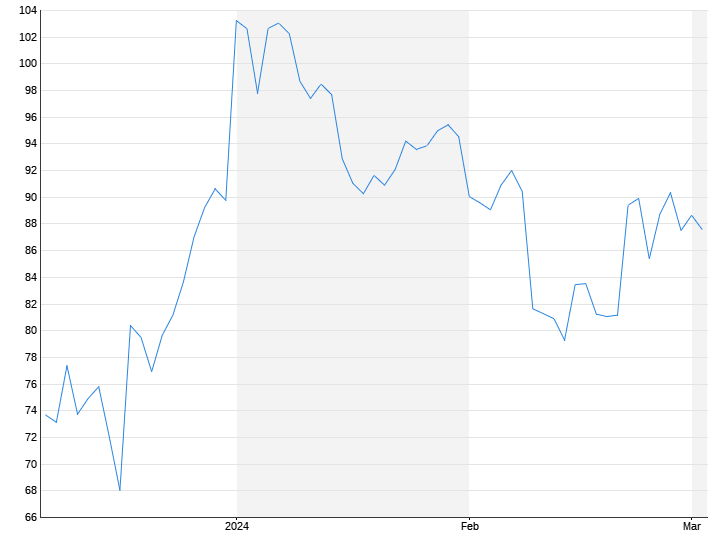

Moderna shares are taking off

Nvidia puts Wall Street in a celebratory mood

This audio version was artificially generated. More info | Send feedback

With its quarterly figures, the chip company Nvidia even exceeded its own expectations. The AI boom is putting US investors in a great buying mood. The drug manufacturer Moderna also surprised with outstanding results.

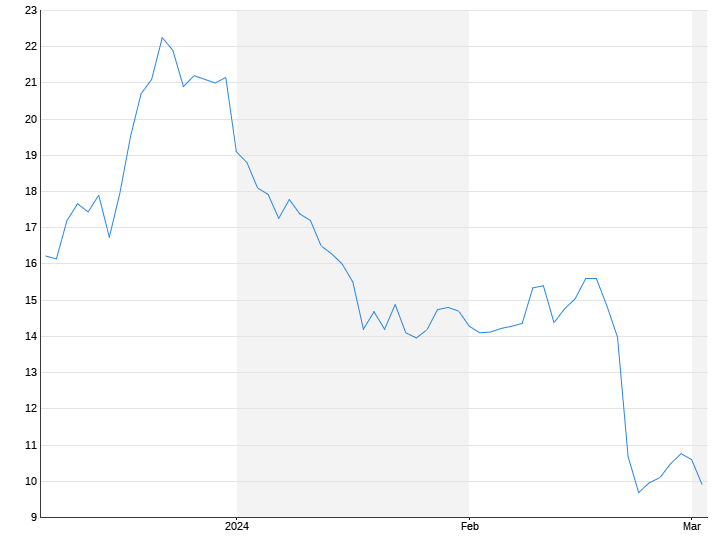

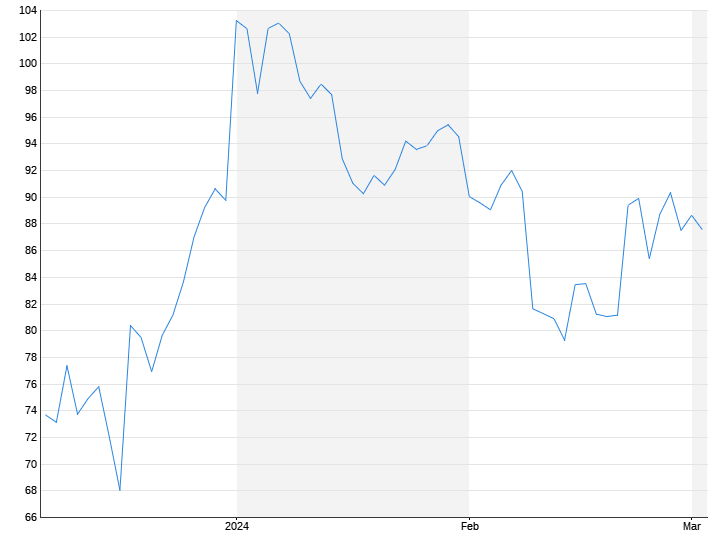

Better-than-expected numbers from Nvidia drove Wall Street. The S&P 500 even set a new record high. The developer of graphics processors and chipsets exceeded analysts' high expectations and its own goals with fourth-quarter revenue. The sales outlook for the current quarter was also above Wall Street expectations. Nvidia shares rose by 16.4 percent. The price rose to a record high. Among competitors' stocks, Advanced Micro Devices gained 10.6 percent.

“Although the Nvidia share price has doubled since its peak in 2021, the world has changed since then and there is significant demand for artificial intelligence. Therefore, Nvidia still has plenty of room for growth. We expect Nvidia shares will reach $1,000 in the next 12 months,” said chief market strategist James Demmert of Main Street Research. On the reporting day, Nvidia shares closed at $785.38.

The Dow Jones Index gained 1.2 percent to 39,069 points. The S&P 500 increased by 2.1 percent and for the technology-heavy Nasdaq Composite it went up by 3.0 percent. The 1,738 (Wednesday: 1,423) price winners on the Nyse were compared to 1,106 (1,391) losers, while 61 (91) stocks closed unchanged.

Fed minutes barely move

With the euphoria surrounding Nvidia's business card, the hawkish tones of the US Federal Reserve faded into the background. The most recent meeting minutes made it clear that interest rate cuts are not expected any time soon. However, the market was already prepared for such a scenario after the US inflation data was recently higher than expected. The evening before, the protocol had only briefly depressed prices. There will be interest rate cuts, but they are still taking a while to arrive, it was said in the trade.

The weekly initial claims for unemployment assistance were better than expected and thus spread economic optimism, which was also positively noted on the stock market. At the same time, they provide further arguments against any imminent interest rate cuts and play into the Fed's hands. The Chicago Fed National Activity Index (CFNAI) did not fit into the picture because it fell. Additionally, activity in the U.S. economy slowed in February, according to a survey from S&P Global.

Bonds fall – oil prices rise

With the premiums on Wall Street, bonds were not in demand. The majority of yields therefore rose, also helped by the hawkish tones of the Fed minutes. The yield on ten-year securities increased by 0.3 basis points to 4.32 percent. According to the CME's FedWatch tool, the probability that the Federal Reserve will confirm interest rates at the next two meetings is 70 percent, up from 62 percent a week ago. A first cut is still expected in June, although the probability of further activity here has risen to 35 percent from 18 percent the previous week.

The dollar index made up for temporary losses and showed little change. In contrast, the euro came under pressure. The common currency barely moved during the day, but at $1.0814 it was well below the daily high of 1.0888. In trading, reference was made to the meeting minutes of the European Central Bank (ECB). This turned out to be more dove-like than expected. At the first meeting of the new year, the mood in the ECB Council once again moved towards lowering interest rates.

Oil prices recovered from temporary levies and rose. The prices for Brent and WTI rose by 0.7 percent each. The ongoing conflict in the Red Sea supported prices, it was said. According to their own statements, the US armed forces have again launched “self-defense attacks” against Houthi rebel positions in Yemen. However, the US oil inventory data, which rose more significantly than expected, is not a burden. The data fueled demand concerns, it said.

Rivian by the numbers in reverse gear

Among the individual values fell Rivian by 25.6 percent after the loss in the fourth quarter was larger than expected. The electric car manufacturer expects production this year to stagnate at last year's level and will lay off 10 percent of its employees. Lucid Group fell by 17.0 percent. With declining sales, the electric vehicle manufacturer slipped deeper into the red in the fourth quarter.

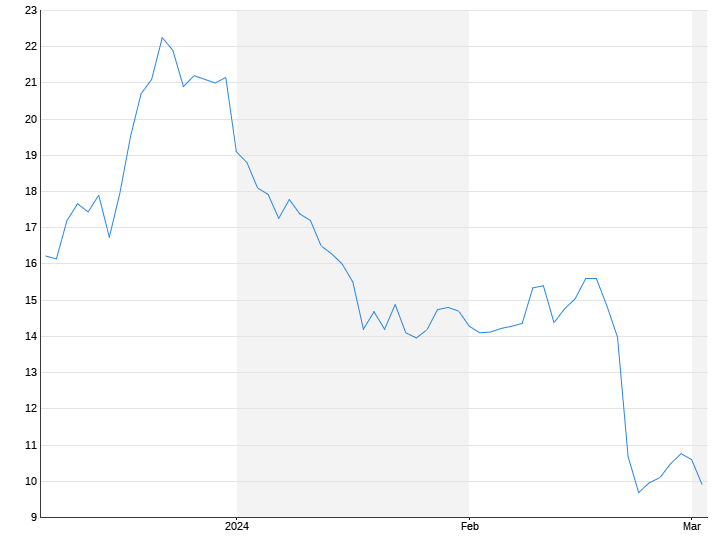

For the shares of Moderna After better-than-expected quarterly figures, sales rose by 13.5 percent. The group's sales fell by a good 64 percent to $6.85 billion last year due to the decline in demand for its Covid-19 vaccines. However, Moderna posted a surprise profit of 55 cents per share in the fourth quarter thanks to cost cuts and deferred payments. On average, analysts had expected a loss of 97 cents.