Welcome to our informative guide on the Canada Tax Calculator 2023 – the perfect tool for accurately estimating your taxes online! As the tax season approaches, there’s no need to stress about calculating your taxes manually or worry about making errors. With the Canada Tax Calculator 2023, you can easily estimate your taxes from the comfort of your own home or office, saving you both time and effort.

The Canada Tax Calculator 2023 is a user-friendly tool designed specifically for Canadians to calculate their taxes for the year 2023. With its accurate algorithm, you can confidently input your income information, deductions, and credits, and receive a precise and comprehensive tax estimate.

In this guide, we will provide you with all the essential information you need to know about the Canada Tax Calculator 2023. We will highlight its benefits, explain how it works, and provide tips and best practices for using the tool effectively. Stick with us to discover how you can make tax filing and planning simple and stress-free with the Canada Tax Calculator 2023!

What is the Canada Tax Calculator 2023?

The Canada Tax Calculator 2023 is a user-friendly tool designed specifically for Canadians to estimate their income taxes for the year 2023. It is a free online resource that can be accessed from anywhere with an internet connection.

Using the Canada Tax Calculator 2023 is a quick and easy way to get an accurate estimate of your taxes. Simply input your income information, deductions, and credits, and the tool will calculate your estimated tax liability.

Accuracy and User-Friendly Interface

One of the key advantages of the Canada Tax Calculator 2023 is its accuracy. The tool is updated regularly to reflect changes in tax laws and regulations, ensuring that your estimate is as precise as possible.

In addition to being accurate, the Canada Tax Calculator 2023 is also user-friendly. Its interface is designed to be intuitive and easy to navigate, making it simple for anyone to use.

“The Canada Tax Calculator 2023 is a game-changer for Canadians. It takes the guesswork out of estimating your taxes and makes tax planning a breeze.”

Why Use the Canada Tax Calculator 2023?

The Canada Tax Calculator 2023 is an essential tool for accurately estimating your income taxes for the year. By utilizing this easy-to-use online calculator, you can save time and hassle by avoiding manual calculations and ensuring that you have the most up-to-date tax information at your fingertips. The benefits of using the Canada Tax Calculator 2023 include:

- Accurate tax estimates: The calculator uses the latest tax rates and rules to provide you with an accurate estimate of your income taxes.

- User-friendly interface: The calculator is designed with simplicity in mind, making it easy for you to enter your income and deduction information and get your tax estimate in just minutes.

- Relevance for Canadians: The Canada Tax Calculator 2023 is specifically tailored for Canadian residents, ensuring that all calculations are relevant and precise.

- Handles various income scenarios: Whether you are an employee, freelancer, or small business owner, the Canada Tax Calculator 2023 can handle a variety of income scenarios, making it a versatile tool for anyone.

Overall, the Canada Tax Calculator 2023 is an indispensable tool for anyone looking to estimate their income taxes with ease and accuracy. By using this online calculator, you can ensure that you are well-prepared for tax season and can make informed decisions regarding your finances.

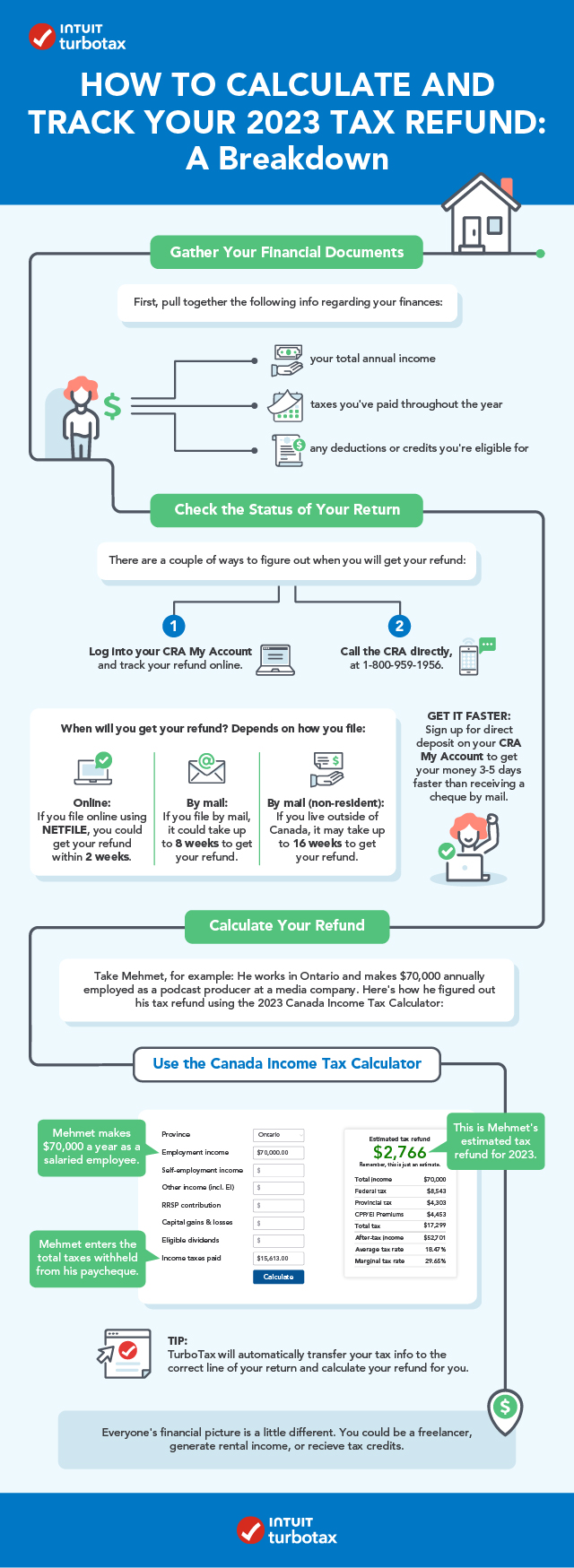

How to Use the Canada Tax Calculator 2023?

Using the Canada Tax Calculator 2023 is easy and straightforward. Here’s a step-by-step guide:

- Visit the Canada Tax Calculator 2023 website.

- Select the Province or Territory where you reside.

- Enter your total income for the year 2023.

- Add any eligible deductions and credits.

- Click on the “Calculate” button.

The Canada Tax Calculator 2023 will then provide you with an accurate tax estimate based on the information you entered.

It’s important to note that the tool may have additional fields depending on your income sources or specific deductions. Be sure to enter all relevant information to get the most accurate tax estimate possible.

The Canada Tax Calculator 2023 is designed to handle a variety of income scenarios, from salaried employees to self-employed individuals. The tool is updated regularly to reflect changes in tax laws, making it a reliable resource for tax planning.

Whether you’re filing your taxes or planning for the upcoming tax year, the Canada Tax Calculator 2023 can help you estimate your taxes with ease and accuracy.

Benefits of Using an Online Tax Calculator

If you’re looking to estimate your taxes quickly and efficiently, an online tax calculator like the Canada Tax Calculator 2023 can be an excellent tool to use. Here are some of the benefits of using an online tax calculator:

- Convenient – You can access the calculator from anywhere with an internet connection, making it easy to estimate your taxes on-the-go or from the comfort of your own home.

- Time-saving – With an online tax calculator, you can save time on calculating your taxes manually or consulting with a tax professional.

- Accurate – Online tax calculators like the Canada Tax Calculator 2023 are designed to provide accurate estimates, ensuring you know exactly how much you may owe or receive in tax refunds.

- User-friendly – Using an online tax calculator is typically straightforward and user-friendly, with step-by-step instructions and helpful prompts to guide you through the process.

- Accessible – An online tax calculator is available to anyone with an internet connection, making it an excellent resource for Canadians looking to estimate their taxes.

By taking advantage of the benefits of an online tax calculator like the Canada Tax Calculator 2023, you can save time, gain accuracy, and easily estimate your taxes for the year 2023.

Understanding Your Tax Estimate Results

After using the Canada Tax Calculator 2023, you will receive an estimate of your income taxes for the year. It is important to understand the various components of this estimate in order to plan effectively.

The first thing to note is your taxable income, which is the amount of income you earned that is subject to taxation. The estimate will also show the tax brackets that apply to your income and the corresponding tax rates.

If you have any deductions or credits, such as RRSP contributions or child care expenses, these will be factored into the estimate. The calculator will apply the appropriate amount of deduction or credit to reduce your taxable income and lower your tax liability.

It is important to note that the estimate provided by the Canada Tax Calculator 2023 is just that: an estimate. Your actual taxes owed may differ slightly due to other factors such as provincial tax rates and changes in your income throughout the year.

If you have any questions or concerns about your tax estimate results, consult with a tax professional or the Canada Revenue Agency for further assistance.

Tips for Using the Canada Tax Calculator 2023 Effectively

To get the most out of the Canada Tax Calculator 2023, follow these tips:

- Gather accurate income information: Make sure to have all relevant income information, including T4 slips and investment statements, before using the calculator. This will ensure accurate tax estimates and help with tax planning.

- Include all applicable deductions and credits: The Canada Tax Calculator 2023 allows users to input various deductions and credits, such as childcare expenses and medical expenses. Be sure to include all applicable deductions and credits to get the most accurate tax estimate.

- Use the tool throughout the year: The Canada Tax Calculator 2023 can be used at any time to estimate taxes and plan for the year ahead. Consider using it to project taxes before making any major financial decisions.

By following these tips, users can maximize the benefits of the Canada Tax Calculator 2023 and make tax planning a breeze.

Other Tax Resources and Services

In addition to the Canada Tax Calculator 2023, there are a variety of tax resources and services available to Canadians. Here are a few options to consider:

| Resource/Service | Description |

|---|---|

| Canada Revenue Agency (CRA) Website | The CRA website offers a wealth of information on taxes, including forms, guides, and publications. You can also set up an online account to manage your taxes and benefits. |

| Commercial Tax Preparation Services | If you prefer to have someone else prepare your taxes, there are many commercial tax preparation services available. These services can be particularly helpful if you have a complex tax situation. |

| Other Online Tax Calculators | While the Canada Tax Calculator 2023 is a great choice for Canadians, there are also other online tax calculators available. Make sure to choose a reputable tool that is tailored to Canadian taxes. |

No matter which resources or services you choose, it’s important to stay informed and up-to-date on changes to tax laws and regulations that may impact your taxes. The more knowledge and information you have, the better equipped you’ll be to manage your taxes effectively.

Stay Informed of Tax Law Changes

As with any tax year, there may be changes to tax laws that can impact your calculations. Stay informed of any changes that may affect your taxes by subscribing to official government newsletters and alerts. You can also consult with a tax professional to ensure you are up-to-date.

Remember to take advantage of the Canada Tax Calculator 2023 in light of any changes. The tool is designed to handle various income scenarios and can provide accurate estimates even with changes to tax laws.

Conclusion

Estimating your taxes accurately can save time and ensure you’re not hit with any surprises. The Canada Tax Calculator 2023 is a powerful tool that can help you do just that, all from the convenience of your own computer or mobile device.

With its user-friendly interface and accurate results, it’s no wonder that Canadians are increasingly turning to this online tax calculator to help them plan for the year ahead. We encourage you to check it out and see how much time and money it can save you.

Remember to Stay Informed

Of course, as with any tax calculator, it’s important to stay on top of any changes in tax laws that may impact your calculations. Don’t forget to keep an eye out for any updates or changes that may affect your tax situation and adjust accordingly.

Thank you for considering the Canada Tax Calculator 2023 as a resource for your tax planning needs. We wish you the best of luck with your taxes in the year ahead!

FAQ

Q: What is the Canada Tax Calculator 2023?

A: The Canada Tax Calculator 2023 is a tool specifically designed for Canadians to calculate their taxes for the year 2023. It provides an accurate estimate of income taxes and features a user-friendly interface.

Q: Why Use the Canada Tax Calculator 2023?

A: The Canada Tax Calculator 2023 helps individuals estimate their income taxes accurately, making tax filing and planning easier. It is relevant for Canadians and can handle various income scenarios.

Q: How to Use the Canada Tax Calculator 2023?

A: To use the Canada Tax Calculator 2023, follow these steps:

1. Input your income information, including deductions and credits.

2. Follow any special features or considerations mentioned in the tool.

Q: What are the Benefits of Using an Online Tax Calculator?

A: Online tax calculators like the Canada Tax Calculator 2023 offer convenience as you can access them from anywhere with an internet connection. You can also save and revisit calculations. They are accurate and reliable.

Q: How to Understand Your Tax Estimate Results?

A: When interpreting the tax estimate results obtained from the Canada Tax Calculator 2023, consider taxable income, tax brackets, and applicable deductions. Understanding these results is important for effective tax planning.

Q: What are Tips for Using the Canada Tax Calculator 2023 Effectively?

A: To use the Canada Tax Calculator 2023 effectively, gather accurate income and deduction information. Utilize the tool throughout the year for better tax planning. Stay informed about any updates or changes to tax laws.

Q: What are Other Tax Resources and Services?

A: In addition to the Canada Tax Calculator 2023, there are other tax resources and services available to Canadians. These include government websites, tax preparation services, and additional tools or resources that may be helpful.

Q: How to Stay Informed of Tax Law Changes?

A: It is important to stay informed about tax law changes that may impact tax calculations for the year 2023. Keep up-to-date with tax-related news and utilize the Canada Tax Calculator 2023 in light of any changes.